The GST council on Saturday announced that it will increase the tax on mobile phones. The council increased the GST on Mobiles to 18 percent. Previously, the tax imposed on mobile phones was 12 percent. This particular decision was taken by the GST Council in the presence of Union Finance Minister Nirmala Sitharaman at the 39th GST Council meeting in the Capital city. GST Council Decides to Hike GST on Mobile Phones From 12% to 18%.

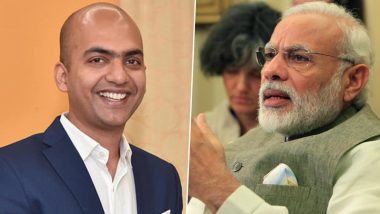

As soon as this news came out, Xiaomi Global VP, Manu Kumar Jain tweeted to PM Narendra Modi & FM Nirmala Sitharaman on Twitter seeking special reconsideration on the GST hike for mobile phones. In his tweet, he also mentioned that this GST price hike will crumble the mobile industry.

My humble request to Hon. PM @NarendraModi ji and FM @nsitharaman ji - please reconsider this #GST hike.🙏

The industry is already struggling with depreciating INR & supply chain disruption due to Covid-19.

At least all devices under $200 (=₹15,000) must be exempted from this. https://t.co/hOMpSpTyKk

— Manu Kumar Jain (@manukumarjain) March 14, 2020

He also highlighted that the smartphone industry is also struggling to make a profit because of continuously depreciating Indian currency. Moreover, he also stated that this step will hamper the Make-in-India program as all the smartphone manufacturer will be forced to increase the prices. GST Hike on Mobile Phones Will Be Detrimental for Local Manufacturing: ICEA.

Xiaomi India Head humbly requested PM Modi & FM Nirmala Sitharaman to please reconsider this GST hike. With the current situation with COVID-19 pandemic, Manu Kumar Jain said that the supply chain has been disruption. Towards the end, he again asked PM Modi to at least exempt all devices under $200 (below Rs 15,000) price bracket from the GST hike.

(The above story first appeared on LatestLY on Mar 14, 2020 08:42 PM IST. For more news and updates on politics, world, sports, entertainment and lifestyle, log on to our website latestly.com).

Quickly

Quickly