Hong Kong - Recently, TickerWin, the leading market research firm, has released a research report " VIYI Algorithm Reported $47.17 Million in Revenue through the Merger of SPAC and VENUS in Its IPO Prospectus ". Special purpose buy-out companies (SPAC) have been around for decades as a way to go public, but have recently emerged as one of the most sought-after vehicles in US capital markets.

How popular is it? A list of names, institutions and data can tell you.

Former basketball player Shaquille O'Neal, SoftBank's Masayoshi Son, Richard Li, former TikTok boss Kevin Mayer, Pershing Square boss Bill Ackman Mr Ackman, Peter Thiel, a prominent Silicon Valley entrepreneur, and Chamath Palihapitiya, a venture capitalist who has risen to prominence recently;

Private equity (PE) giants, including Apollo, Ares, Bain, KKR and TPG, have also flocked to SPAC;

In 2020, SPAC emerged as a new force in the US capital market. A total of 248 SPACS were listed (accounting for 52.7% of the TOTAL number of IPOS in the US in that year), raising 83.042 billion US dollars (accounting for 53.5% of the total amount of IPOS in the US in that year), surpassing the traditional IPO mode for the first time and becoming a milestone in the capital market. It was called "SPAC Year one" by the media.

In terms of exchange rates, the amount of funds raised by U.S. SPAC in 2020 also exceeded the amount raised by Hong Kong stock ipos (HK $397.7 billion) that year.

By the end of February 2021, 201 SPacs had gone public, raising close to $65bn (with a long queue of ipos to follow).

Investors subscribe to THE shares of SPAC mainly because they believe in the influence of sponsors and management, investment ability, human resources... This is why so many stars and business leaders have launched SPAC.

VIYI Algo has announced that it will go public through a merger with SPAC Venus Acquisition Corporation. VIYI algorithms is valued at $400 million. Venus will be renamed MicroAlgo Inc. after the deal closes. The merger will be completed in the third quarter of 2021. It is reported that Viyi algorithm is one of the top central processing algorithm services. By 2020, Viyi had captured 5 percent of the market for central processing algorithm services to the Internet advertising and online game acceleration industries, according to the CIC report.

VIYI is dedicated to the development and application of bespoke central processing algorithms. VIYI provides comprehensive solutions to customers by integrating central processing algorithms with software or hardware, or both, thereby helping them increase the number of customers, improve end-user satisfaction, achieve direct cost savings, reduce power consumption, and achieve technical goals. The range of VIYI's services include algorithm optimization, accelerating computing power without the need for hardware upgrades, lightweight data processing, and data intelligence services. VIYI's ability to efficiently deliver software and hardware optimization to customers through bespoke central processing algorithms serves as a driving force for VIYI's long-term development.

Central processing algorithms refer to a range of computing algorithms, including analytical algorithms, recommendation algorithms, and acceleration algorithms. According to the CIC Report, businesses engaged in internet advertisement, game development, intelligent chip design, finance, retail, and logistics depend on the ability to efficiently process and analyze data with optimized computing software and hardware capable of handling the data workload. Bespoke central processing algorithms suitable to each customer's distinct needs help them achieve this purpose.

Currently, VIYI is focused on developing and delivering central processing algorithm solutions to customers engaged in internet advertisement and gaming, and intelligent chips. Moreover, VIYI's customer base is rapidly growing due to the increase in a general demand for more efficient data processing in various industries driven by the growing internet population and prevalence of AI. According to the CIC Report, revenue of central processing algorithm services derived from internet advertisement and online gaming alone has grown from RMB 2.2 billion in 2016 to RMB 6.9 billion in 2020, representing a CAGR of 32.7%. This market is expected to maintain a rapid growth trend, expanding at a CAGR of 15% during the period from 2020 to 2025 in terms of dollar value.

VIYI's Ecosystem and Its Participants

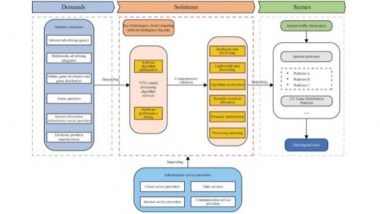

VIYI has effectively established an ecosystem centered around internet advertisement, games, and intelligent chip optimization. VIYI connects with market participants representing every stage in these core industry verticals. They include advertisers, internet advertising integration agencies, internet traffic wholesalers, online platforms, online game developers and distributors, cloud service providers, electronics manufacturers, internet information infrastructure service providers, and internet users, as illustrated in the diagram below:

VIYI's revenue from digital marketing is derived based on the effectiveness of VIYI's ad placement. VIYI's one-stop-shop service solutions enable internet advertising integration agencies to complete cost-effective advertising placements, which allows them to acquire, transform and retain advertisers efficiently.

As cost outlays, VIYI purchases advertisement placement opportunities from internet traffic wholesalers. VIYI also pays corresponding fees to internet traffic wholesalers based on the CPM charging model.

To ensure a continuous stream of revenue, VIYI is constantly updating the inventory of advertisements ready for placement to internet traffic wholesalers with whom VIYI partners. They include short video platforms, video platforms for drama series and films, as well as news and information platforms. VIYI is constantly updating internet traffic wholesalers' advertisement inventories in real-time for maximum effectiveness. The central processing algorithm services VIYI provides are able to meet these real-time requirements. Therefore, VIYI believes that its services are critical to helping VIYI's customers to achieve high conversion rates.

VIYI's revenue from the gaming industry is mainly derived from sales commissions. VIYI collaborated with numerous online game developers and game distributors in operating online games, which are made available on VIYI's online game platform. VIYI provides online game developers and game distributors with value-added services through customized central processing algorithm processing services, including lightweight data processing, computing power, and algorithm optimizations as well as game acceleration.

VIYI algo uses cloud services to ensure that its central processing algorithm services are maintained in a safe and reliable environment.

VIYI's revenue from the intelligent chip industry is derived from service fees and sales revenue. Electronics manufacturers and internet information infrastructure service providers rely on VIYI's intelligent chip optimization solutions; VIYI provides them with hardware and software integrated intelligent chip optimization solution services that combine chip hardware and smart application software.

The SPAC raised $83 billion in 2020, and continued to soar in 2021, reaching $100 billion in the first three months of this year.

Goldman Sachs has said in a research note that the current low interest rate environment is fueling the SPAC boom. Interest rates near zero make the SPAC a low opportunity cost for investors. SPAC promoters can earn a minimum return on their initial investment while they are looking for companies to buy, and can choose to redeem their shares if they do not like the potential acquirer.

In addition, companies listing through SPAC can have direct, confidential and rapid negotiations with SPAC without a large-scale road show, which is in line with the quarantine requirement of "reducing exposure."

Retail investors' appetite for non-traditional businesses could also be a driver of SPAC's boom. Goldman argues that new tracks with high growth potential are emerging, with small and mid-sized companies constrained by their size and less likely to trade publicly. And the public's enthusiasm for investment has encouraged these smes to access secondary market financing through SPAC's fast-track listing.

About TickerWin

TickerWin (https://tickerwin.com) is a leading market research firm in Hong Kong. They have built a proprietary research platform in the financial markets. TickerWin focuses on emerging growth companies and paradigm shifting companies. TickerWin has a team of professionals with a proven track record in market research reports, industry analysis and financing trend analysis.

Quickly

Quickly