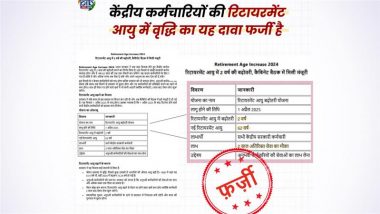

New Delhi, September 29: With the advent of social media, misinformation is rampant as fake news overshadowed fact. Recently, one such fake news which is doing rounds on social media claimed that Central Board of Indirect Taxes and Customs issued an order making changes under Central Goods Services Act, 2017.

According to the claim, every registered person, other than input service distributor, a person paying tax under section 51 or section 52 needs to furnish an annual return for every financial year. However, the government denied the claim. The PIB Fact Check termed the order as fake. Students to Be Rewarded With Scholarship Up to Rs 1 Lakh Through National Scholarship Exam? PIB Debunks False News, Reveals Truth Behind Fake Website

The PIB Fact Check tweeted, “Claim: An order purportedly issued by Central Board of Indirect Taxes and Customs claims that certain changes are being made under Central Goods Services Act, 2017 #PIBFactCheck: This order is #Fake. No such order dated 28th Sep, 2020 has been issued by @cbic_india @FinMinIndia.” WhatsApp Post Claiming People Who Worked Between 1990 And 2020 Are Eligible to Get Rs 1.2 Lakh Goes Viral, PIB Fact Check Finds The Message Fake.

Tweet by PIB Fact Check:

Claim: An order purportedly issued by Central Board of Indirect Taxes and Customs claims that certain changes are being made under Central Goods Services Act, 2017#PIBFactCheck: This order is #Fake. No such order dated 28th Sep, 2020 has been issued by @cbic_india @FinMinIndia pic.twitter.com/o18qxQR4HW

— PIB Fact Check (@PIBFactCheck) September 29, 2020

The Central Board of Indirect Taxes and Customs also took to Twitter to debunk the fake news. The tax policy body said that no such order was passed by it. It also asked people to visit official CBIC website. It also asked people not to believe the fake news.

(The above story first appeared on LatestLY on Sep 29, 2020 08:04 PM IST. For more news and updates on politics, world, sports, entertainment and lifestyle, log on to our website latestly.com).

Quickly

Quickly