Jewelry in today’s world is a representation of you. Meit Kamdar Avlanii views jewelry as an enhancement of the status quo and an expression of your personal opinion on style and trends. In a pandemic-hit world, Meit notes that the industry has been hard hit but investing in jewelry still makes sense as Fine metals & gems are always going to be great for tangible and movable investment.

According to Meit Kamdar Alvanii, jewelry buying is always a well-thought purchase that celebrates an occasion, achievement, or investing into continuation of a legacy through heirlooms to be passed on in the future. Being a sentimental product, jewelry is intrinsically woven into daily life across different cultures no matter the economic background.

Investing in fine jewelry, especially amid the pandemic if income permits it, is a sensible move. Mainly because it is a valuable item made with fine materials like gold, silver and platinum. People who have the extra disposable income amid the pandemic should turn to jewelry as a worthy alternative to channelise surplus income fulfilling the void left by a lack of travel, shopping, dining etc.

Fine Jewellery is made of gold, silver, platinum and ever since the discovery of these metals and its use into human life, these metals have grown in value as a thumb rule. Gold is a valuable metal and also an instant instrument to cash out any time. Gold is the world’s oldest safe asset, always thriving in times of uncertainty. As per World Gold Council, the gold prices in the last 50 years have soared from $2690/kg in 1973 to $ 61,063 as on today. Gold or gold jewellery is always a good investment. Diamonds and Gems on the other hand are precious stones and historically the prices have gone up ten fold over the last half a century. Jewellery will always be a tangible asset investment for the future that is easily movable and saleable. With a little bit of research and study, one can purchase good pieces of jewellery at the right price and take the benefits of its natural appreciation over time.

Another way to invest into jewellery is by buying rare gems or one of a kind pieces of known jewellery designers or artists. One of a kind pieces of jewellery by renowned designers like Bhagat, JAR, Cartier etc are sold in auction houses for the top dollar and with time the value of such gems and jewellery increases sheerly because of its demand as a collectible and its natural paucity and scarcity. Always keep in mind - the piece is authentic, certified, stamped by a jeweller and has a proper provenance.

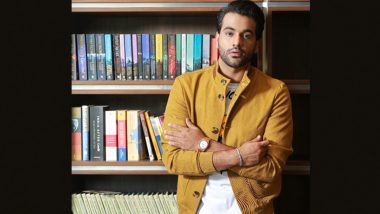

Meit Kamdar Avlanii is the founder of his name sake Atelier He is a jewelry designer and enthusiast whose knowledge of the jewelry industry is vast. His interest in design, aesthetics and fine jewelry trends has seen him become a renowned jewelry designer. His boutique Atelier displays limited-edition jewelry pieces, each with a unique visual appeal. Some of his pieces have been auctioned in the past at renowned auction houses in India and abroad.

Quickly

Quickly