New Delhi, May 4: The GST Council on Friday approved the rollout of a new simplified process under which a taxpayer will have to file a maximum of one GST return every month. For composition dealers and dealers with "nil transaction", only one return will have to be filed every quarter.

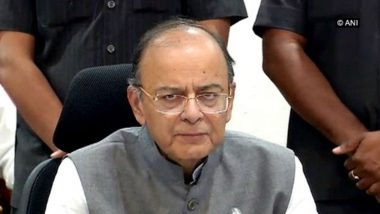

The new system would be put in place within the next six months and another six months would be given to the taxpayers to make the complete transition, Finance Minister Arun Jaitley announced after the 27th meeting of the Goods and Services Tax (GST) Council here.

"There will be a three-stage transition to the new system," Finance Secretary Hasmukh Adhia explained.

"In the first stage, the present system of filing of return GSTR 3B and GSTR 1 will continue for six months by which time, new return software would be ready."

The new system will be rolled out in the second stage and it will have a facility for invoice-wise data upload.

"But during the first six months of its implementation, there will also be a facility for claiming provisional input tax credit on self-declaration basis, as in case of GSTR 3B now," Adhia said.

"After six months of this phase, the facility of provisional credit will be withdrawn and input tax credit will be given to the buyer only if invoices are uploaded by the seller."

Apart from that, the return form will also be simplified by reducing the information required to be filled in. While B2B dealers will have to fill invoice-wise details of the outward supply made by them, B2C dealers will have to just declare their total turnover on different tax slabs.

"Based on the return filed, the system will automatically calculate the tax liability. The input tax credit will be calculated automatically as well based on invoices uploaded by the sellers," the Finance Secretary said.

What makes the new process much simpler is that unlike the system proposed earlier, the buyer will not have to upload any invoice. The buyer can simply view the invoices uploaded by the seller and confirm them.

"So there will only be a unidirectional flow of invoices unlike the bilateral flow earlier. And there will be no requirement of invoice matching," Adhia said.

The GST Council also ruled out the automatic reversal of input tax credit from the buyer on non-payment of tax by the seller.

"In case of default in the payment of tax by the seller, recovery shall be made from the seller. However, reversal of credit from the buyer through due process of law shall also be an option available with the revenue authorities to address exceptional situations like missing dealer, closure of business by supplier or supplier not having adequate assets," Adhia said.

The industry welcomed the new, simplified and single monthly return, but warned that provisional credit may give rise to avoidable disputes and litigation.

ClearTax Founder and CEO Archit Gupta called it a welcome step. "It will reduce compliance burden and boost ease of doing business. With the staggered approach, businesses can transition easily," he said.

Saloni Roy, senior director at Deloitte India, said the model of filing single monthly return would reduce the compliance burden significantly from the multiple filings currently required in a month.

S. Mani, also a senior director at Deloitte India, added the staggered introduction of the new returns would enable businesses to prepare for the same and make changes to their systems.

"Simplicity of the new returns would be key to its successful adoption by businesses as past experience with complicated forms and processes indicates that complexity reduces compliance," Mani said.

Sachin Menon, partner and head (Indirect Tax) at KPMG in India, said while the new model shall give unconditional input credit to the buyer, once invoice uploaded by the seller in the system is accepted by the buyer, provisional credit will give rise to avoidable disputes and litigation.

(The above story first appeared on LatestLY on May 04, 2018 08:21 PM IST. For more news and updates on politics, world, sports, entertainment and lifestyle, log on to our website latestly.com).

Quickly

Quickly