New Delhi, March 5: Economic Advisory Council to the Prime Minister (EAC-PM) Chairman Bibek Debroy on Friday said that while giving the message that tax rates will remain stable, the Union Budget 2021-22 focussed on promoting growth by driving reforms to boost consumption, investment and government expenditure.

The economic growth in the next financial year has been pegged at 11 per cent. In the current financial year, the economy is estimated to contract by 8 per cent on account of the coronavirus pandemic. He said real growth sector comes from four different sources -- consumption, investment, government expenditure, and net exports. Impact of GST Will Take Time to Show Results: Bibek Debroy.

However, there is a lot of uncertainty surrounding growth in the external sector. "So, the real sector growth has to primarily come about through consumption, investments and government expenditure...the budget drives reforms on all three counts, consumption, investment, and government expenditure.

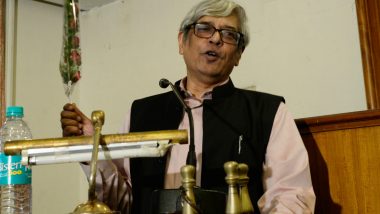

"All too often historically budgets have been associated with tinkering in the tax rates. One of the messages in this budget is the message that tax rates will have stability," he said at the Dun & Bradstreet BFSI & FinTech Summit 2021. Finance Minister Nirmala Sitharaman had presented the Budget 2021-22 in Parliament on February 1.

Observing that 2021-22 numbers are going to be good because of the base effect, Debroy said, "What is important for us to ponder about and what is important for us to ask is not what is going to happen in 2021-22 but what is going to happen from 2022-23.”

The numbers in 2022-23 are not going to be that spectacular, he said adding that "but in nominal growth terms, once the effects of the low base are out of the way even in 2022-23, we will probably get a nominal GDP growth rate of around 11 per cent which again means corporate average corporate profitability of 17-18 per cent."

Debroy further said the worst of the COVID-19 crisis, economic activity wise, is over, and "we can look forward with some optimism for the economy in general". Speaking at the event, Chief Economic Advisor Krishnamurthy Subramanian said India's financial sector has not really grown as fast as it should have and is "still very, very small".

For instance, he said, while India is the fifth largest economy in the world, the largest Indian financial institution that is SBI is ranked 55th in the world. On the other hand, countries which are a mere fraction of India's size have several of their financial institutions featuring among the top 100 in the world.

He also said the Budget has made a significant push towards reforming the financial sector and adding vitality to it. The chief economic advisor also stressed that financial technology (fintech) can play a significant role in improving both the quanity and the quality of the financial intermediation in the country.

Subramanian further said while banks, especially public sector lenders, are investing in data architecture, "we still have a long way to go" in enabling the kind of data architecture that banks globally employ.

Dun & Bradstreet India Managing Director Avinash Gupta said digital technologies have played a great role in keeping Indians connected and "transactional" during the lockdown situation.

As a matter of fact, he said digital transactions to the tune of about Rs 4,525 crore have already been executed between April 2020 and March 1, 2021, as against a target of Rs 4,630 crore set for the entire fiscal year.

"This trend is likely to only scale newer heights going forward. Although initially, it was necessity that drove motivated Indians to leverage digital technologies, now, it is speed and convenience that is likely to keep them constantly engaged with digital technologies," Gupta said.

Quickly

Quickly