New Delhi, April 15: India's largest commercial lender State Bank of India (SBI) has slashed its savings account interest rate by 25 basis points at 2.75 percent per annum. Earlier, the savings account holder used to get 3 percent interest. The revised rates will be applicable from Sunday, April 19. The bank had last cut rates on March 11 when it brought interest rate down to 3 percent from 3.25 percent. State Bank of India Removes Minimum Balance Requirement.

The decision to cut savings account interest rates comes after the Reserve Bank of India (RBI) cut the repo rate by 75 basis points. Recently, the lender had also waived off the minimum monthly balance requirement for customers of savings accounts. SBI Reduces MCLR by 10 to 15 Basis Points Across All Tenors, Home Loan, Car Loan to Become Cheaper.

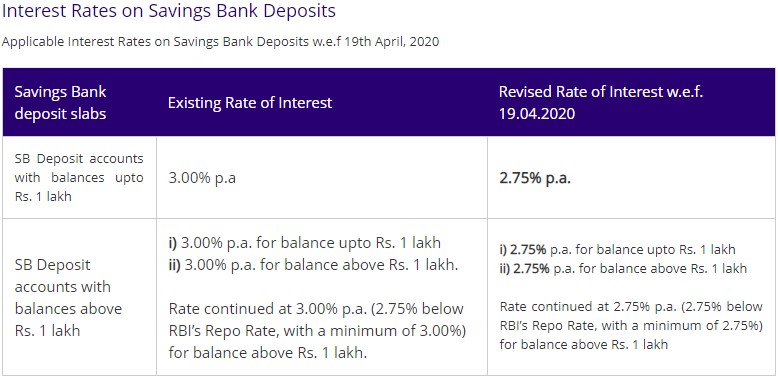

Revised Interest Rates on Savings Bank Deposits:

The State Bank of India has also reduced marginal cost of funds based lending rate (MCLR) across all tenors by 35 bps. The revised one-year MCLR has come down to 7.40 per cent per annum, effective from April 10.

Last week, ICICI Bank had also reduced savings bank account rates by 25 basis points. Savings account having balances below will earn 3.25 percent per annum, while account having balances of Rs 50 lakh and above will earn 3.75 percent per annum.

(The above story first appeared on LatestLY on Apr 15, 2020 03:58 PM IST. For more news and updates on politics, world, sports, entertainment and lifestyle, log on to our website latestly.com).

Quickly

Quickly