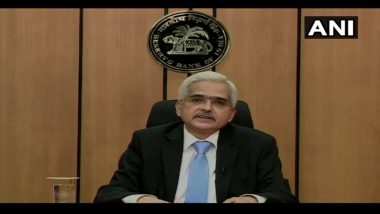

Mumbai, April 17: The Reserve Bank of India Governor Shaktikanta Das on Friday said the central bank will ensure adequate liquidity in the system to ease the financial stress caused by the Covid-19 pandemic.

The central bank reduced the reverse repo rate - the rate at which banks park their fund with the central bank - by 25 basis points to 3.75 per cent. This will encourage banks to lend to the productive sectors of the economy. Click here to follow LIVE updates on Coronavirus Outbreak.

With regard to other measures, Das said RBI will begin with giving an additional Rs 50,000 crore through targeted long-term repo operation (TLTRO) to be undertaken in tranches. Besides, he announced a re-financing window of Rs 50,000 crore for financial institutions like Nabard, National Housing Bank and Sidbi. RBI Reduces Reverse Repo Rate by 25 BPS to 3.75%, Announces Rs 50,000 Crore Liquidity Package For Small Industries, Struggling Sectors, Makes Important Announcement on NPAs.

He further said surplus liquidity in the banking system has increased substantially as result of central bank's actions. Stating that the RBI is monitoring situation developing out of Covid-19 outbreak, he noted that the contraction in exports in March at 34.6 per cent much more severe than global financial crisis of 2008-09.

Quickly

Quickly