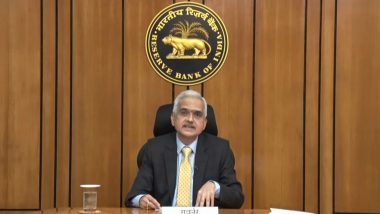

Mumbai, February 10: The voluntary retention route (VRR) cap for foreign portfolio investors (FPIs) will be enhanced by Rs 1 lakh crore to Rs 2.50 lakh crore, given the increased interest shown by them, Reserve Bank of India Governor Shaktikanta Das announced on Thursday.

The enhancement of VRR, which seeks to provide a separate channel, broadly free of macroprudential controls, to FPI investments in government and corporate debt securities will be applicable from April 1, Das said. He said a dedicated investment limit of Rs 1,50,000 crore was set for investments under the VRR earlier.

The enhancement is being done “given the positive response to the VRR as evident from the near exhaustion of the current limit”, Das noted. It can be noted that the move also comes at a time when the hardening of rates in developed markets is increasing investor interest in other markets. RBI Projects India GDP Growth Rate at 7.8% for Financial Year 2022-23.

Das also announced that India will be issuing reviewed guidelines on credit default swaps (CDS), nearly nine years after first issuing the guidelines. The CDS market is important for the development of a liquid market for corporate bonds, especially for the bonds of lower-rated issuers, he said.

Das said given the importance of the CDS market - which had gained infamy following the 2008 global financial crisis – the first review of the guidelines was announced in December 2000 and the draft guidelines were issued a year ago. The final directions will take into account the feedback received on the draft guidelines.

Quickly

Quickly