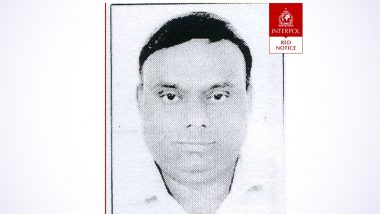

Mumbai, July 23: Gitanjali Gems owner Mehul Choksi, key accused in the Punjab National Bank (PNB) fraud case, on Monday moved the Prevention of Money Laundering Act Court seeking cancellation of a non-bailable warrant (NBW) against him. Choksi filed the application, under Section 70(2) of the Code of Criminal Procedure (CrPC).

The non-bailable warrant was issued against him after the Enforcement Directorate (ED) in June filed two separate applications in a special Prevention of Money Laundering Act (PMLA) court in Mumbai against Nirav and Choksi under Fugitive Economic Offenders Ordinance, 2018.

According to the application, Choksi is a "law-abiding citizen" and "never shied away from the investigation or the investigating agencies and duly responded to all the communications received by him from the investigating agencies." It states that due to ill health, Choksi left for abroad for a regular health checkup.

"Subsequently, his passport was revoked which made him unable to travel abroad. Companies associated with Choksi were freezed and the serves of the company were taken away due to which it became impossible for the company to function and when the company stopped functioning the employees of the company were not paid their salaries and the debtors of the company were not paid their debt due to which all the persons became agitated against the present applicant and he started facing serious threat to his life which made it difficult for him to return though he left only for the purposes of medical treatment which fact was also apprised to the investigating agency," the application stated.

Citing example of mob lynching in India, Choksi in the application stated that following persons have "grievances and anger" against him - the existing employees whose salaries and dues have not been paid because of freezing of the accounts; the families of detained employees who have been arrested without any rhyme or reason; the landlords whose premises the companies had taken on rent, who have not been paid their dues; the customers whose jewellery in showroom have been taken away by the Enforcement Directorate (ED); the creditors of supplies and services, who have not been paid their dues.

The application further mentions that the assets of Choksi and other companies were seized making him monetarily handicapped "without even hearing the various respondents in the petition." "It has been pleaded that the zeal to get information, by whatsoever means, including by third-degree methods and torture is not unknown on the part of ED/CBI (Central Bureau of Investigation)," the application stated.

It also mentions the "fact of the poor conditions in the jail in India and the threat Mehul Choksi would face from the other inmates who are hard earned criminals." Choksi in his application has also mentioned the "high risk of extortion by jail staff and the other inmates".

"If Mehul Choksi had the intention to run away from the jurisdiction of the court or from the country then Mehul Choksi would not have left property worth crores in the country which fact is clear from this various seizure made by the Enforcement Directorate wherein the Enforcement Directorate has seized articles worth more than 5000 crores. It is a commercial common sense that the PNB could have recovered all its dues from the properties itself," the application added.

It was also mentioned that in terms of Section 212 (2) of the Companies Act, 2013 the proceedings in the PMLA case cannot continue as the present case has been assigned by the central government to the Serious Fraud Investigation Office for investigation.

"Hence, no other investigating agency of the central government (in the present case, CBI) can proceed with investigation in such case and in case any such investigation has already been initiated, it shall not be proceeded further with and the concerned agency shall transfer the relevant documents and records in respect of such offences under this Act to Serious Fraud Investigation Office," the application read.

Meanwhile, another application was filed by accused Vipul Chetalia though advocate Sajay Abbot under Section 44 of the PMLA seeking that the trial pending before the Special PMLA Judge be committed to the Special CBI Judge. Both the applications will be heard on August 18.

For those unversed, the PNB detected the multi-crore scam earlier this year wherein Nirav and Choksi had allegedly cheated the bank to the tune of USD 2 billion, with the purported involvement of a few employees of the bank.

Quickly

Quickly