Mumbai, December 7: The RBI on Wednesday expectedly slowed the pace of increase in borrowing costs in signs that rates may be nearing the peak, even as it reiterated its resolve to fight inflation that has stayed above the comfort zone for 10 straight months.

The Reserve Bank of India (RBI) hiked the key repo rate by 35 basis points, the fifth straight increase since May, raising prospects of EMIs for home, auto and other loans rising further. The previous four increases totalled 190 bps, with the last three hikes being 50 bps each.

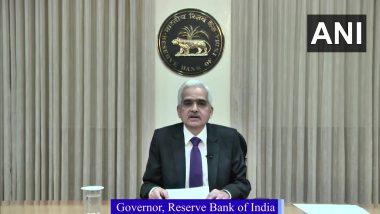

The monetary policy committee (MPC), comprising three members from the RBI and three external members, raised the key lending rate or the repo rate to 6.25 per cent by a 5:1 majority decision. Four of the six members voted in favour of the withdrawal of accommodation, RBI Governor Shaktikanta Das said. RBI Monetary Policy Meet 2022: Reserve Bank of India Hikes Benchmark Lending Rate by 35 Basis Points To 6.25% To Tame Inflation.

The economic "growth in India remains resilient, and inflation is expected to moderate," Das said. "But the battle against inflation is not over." The RBI retained its 6.7 per cent inflation forecast for the current fiscal year ending March but lowered economic growth expectation to 6.8 per cent from the 7 per cent forecast previously.

RBI Hikes Benchmark Lending Rate By 35 Basis Points To 6.25%; Fifth Consecutive Rate Hike

Retail inflation, which has stayed above the 2-6 per cent target zone for 10 straight months, eased to a three-month low of 6.77 per cent in October, helped by a slower rise in food prices and a higher base effect.

Das said the inflation is moderating.

"The worst of inflation is behind us," he said, adding there is no room for complacency. The central bank, whose primary mandate is to ensure price stability, last month wrote a letter to the government, explaining how global factors contributed to its failure to keep inflation below the target zone for three straight quarters. On the same note, it outlined a roadmap to bring price gains within target.

Announcing the monetary policy committee's decisions, Das said the main risk is that inflation could remain sticky and elevated. "The MPC was of the view that further calibrated monetary policy action was warranted to keep inflation expectations anchored, break core-inflation persistence and contain second-round effects," he said.

Acuite Ratings and Research said the RBI's stance has remained moderately hawkish, and there exists a possibility of a further round of rate hikes in February next year, with a potential terminal rate of 6.5 per cent by the beginning of FY24.

The pass-through of higher rates to home loans may start to impact the demand for housing, particularly in the mid to high-ticket segment, it noted.

Das said the Indian economy remains resilient, drawing strength from its macroeconomic fundamentals. RBI Monetary Policy Meet 2022: ‘Worst of Inflation Behind Us, But No Room For Complacency’, Says Governor Shaktikanta Das.

The outlook for the economy is supported by good progress of rabi sowing, sustained urban demand, improving rural demand, a pick-up in manufacturing, a rebound in services and robust credit expansion.

"India is widely seen as a bright spot in an otherwise gloomy world," he said. "Yet, our inflation remains elevated as in most parts of the world. Global spillovers continue to impart high volatility and uncertainty."

India posted a GDP growth of 6.3 per cent in the July-September quarter, slightly better than expected but less than half the 13.5 per cent growth in the previous three months. "The focus on the inflation fight continues. There will be no let up in that," Das said.

He said food inflation is likely to moderate with the usual winter softening and the likelihood of a bountiful rabi harvest, but pressure points remain in the form of prices of cereals, milk and spices in the near term. Assuming an average crude oil price of USD 100 per barrel, headline inflation is projected at 6.7 per cent in 2022-23, with Q3 at 6.6 per cent and Q4 at 5.9 per cent.

The current account deficit (CAD) is manageable, he said, adding the rupee movements have been the least disruptive, relative to its peers.

Quickly

Quickly