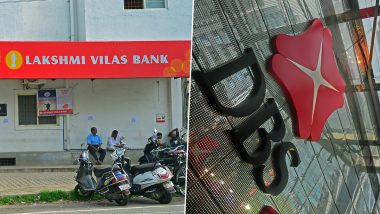

New Delhi, November 30: DBS Bank India on Monday said customers of Lakshmi Vilas Bank, which has now been merged with it, can continue to access all banking services, and interest rates on savings and fixed deposits are unchanged as of now. Lakshmi Vilas Bank (LVB) has now been amalgamated with DBS Bank India Ltd (DBIL), the wholly-owned subsidiary of DBS Group Holdings Ltd, DBS Bank India said in a statement.

The amalgamation of LVB into DBS Bank India came into effect from November 27 under the special powers of the government and the Reserve Bank of India under Section 45 of the Banking Regulation Act, 1949. Lakshmi Vilas Bank Merger with DBS India Cleared by Cabinet.

The amalgamation provides stability and better prospects to LVB's depositors, customers and employees following a period of uncertainty. The moratorium imposed on LVB was lifted from November 27, and the banking services were restored immediately with all branches, digital channels and ATMs functioning as usual.

"LVB customers can continue to access all banking services. The interest rates on savings bank accounts and fixed deposits are governed by the rates offered by the erstwhile LVB till further notice," DBS Bank said.

All LVB employees will continue to be in service and are now employees of DBIL on the same terms and conditions of service as under LVB, it added.

The Indian arm of Singapore's DBS said its team is working closely with LVB colleagues to integrate LVB's systems and network into DBS over the coming months.

Once the integration is complete, customers will be able to access a wider range of products and services, including access to the full suite of DBS digital banking services that have won multiple global accolades, it added.

DBIL Chief Executive Officer Surojit Shome said, "The amalgamation of LVB has enabled us to provide stability to LVB's depositors and employees. It also gives us access to a larger set of customers and cities where we do not currently have a presence."

He added that the bank looks forward to working with its new colleagues towards being a strong banking partner to LVB's client. The bank said it is well capitalised and its capital adequacy ratio (CAR) will remain above regulatory requirements even after the amalgamation.

Additionally, DBS Group will inject Rs 2,500 crore (SGD 463 million) into DBIL to support the amalgamation and for future growth. This will be fully funded from DBS Group's existing resources. DBS has been in India since 1994 and converted its India operations to a wholly-owned subsidiary, DBIL, in March 2019. From Changes in LPG Prices to RTGS Timings, Here Are Some Changes Which Will Come Into Effect From December 1, 2020.

On November 17, a 30-day moratorium was imposed on the crisis-ridden LVB restricting cash withdrawal at Rs 25,000 per depositor. The Reserve Bank of India (RBI) simultaneously placed in public domain a draft scheme of amalgamation of LVB with DBIL, a banking company incorporated in India under the Companies Act, 2013, and having its registered office at New Delhi.

LVB is the second private sector bank after Yes Bank that has run into rough weather during this year. In March, capital-starved Yes Bank was placed under a moratorium. The government rescued Yes Bank by asking state-owned State Bank of India to infuse Rs 7,250 crore and take 45 per cent stake in the bank.

Quickly

Quickly