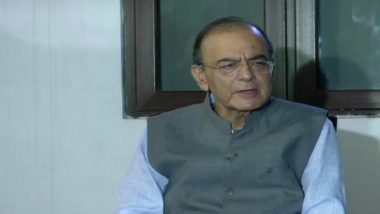

New Delhi, September 28: Are some items including luxury cars going to become expensive? The 30th meeting of the Goods And Services Tax (GST) Council was held today, following which Finance Minister Arun Jaitley said that a disaster cess on certain items is being considered. Jaitley said that a 7-member group of ministers has been set up to discuss the Kerala floods cess proposal.

"We are making a 7 member group of ministers which will discuss the Kerala Cess proposal. This 7 member committee will have members of North East, hill and coastal states. Committee members will be announced soon," Jaitley said on Friday after the GST council meet. Kerala Floods: Contributions to Kerala CM's Distress Relief Fund Reach Rs 1,027 Crore

Jaitley had proposed additional cess on select commodities under GST to raise funds to help Kerala that suffered huge damages due to floods. The initial proposal for an additional 1 per cent cess to be levied for a specific period of time was made by the Kerala government in a meeting between Jaitley and state Finance Minister Thomas Isaac. Kerala Floods: Centre Releases Rs 320 Crore to Kerala Government as Disaster Relief Fund in 2018-19

The government may have to amend the GST law to permit imposition of a new cess in the new indirect tax regime. Rolled out from July 1, 2017, Goods and Services Tax (GST) has subsumed all cess, surcharge and local levies.

The GST currently has a four-slab rate structure of 5, 12, 18 and 28 per cent. Besides, luxury items, sin and demerit goods attract a cess on top of the highest tax rate.

Isaac had also pressed for additional funds from the Centre to rebuild the state, which is estimated to have suffered a loss of Rs 20,000 crore (as per a preliminary estimate) due to the floods.

(The above story first appeared on LatestLY on Sep 28, 2018 02:07 PM IST. For more news and updates on politics, world, sports, entertainment and lifestyle, log on to our website latestly.com).

Quickly

Quickly