New Delhi, Jun 9: Parvez Ahmed, who was removed as the Chairman of the J&K Bank, was allegedly involved in corruption, nepotism and favouritism, and the action against him was an effort to combat such activities and bring mighty people with "dubious credentials" before law, officials said Sunday. Jammu And Kashmir: Terrorists Loot Cash From J&K Bank in Shopian; Snatch 12 Bore Rifle From Security Guard.

The action was taken by the Anti Corruption Bureau(ACB), which was established a few months ago in Jammu and Kashmir, currently under the President's rule, following persistence of the Ministry of Home Affairs to improve governance, clamp down on terror-funding and money laundering.

#JammuAndKashmir Anti-Corruption Bureau: The searches of the premises of J&K Bank which started yesterday after registration of FIR by Anti Corruption Bureau has concluded today. Further investigation is going on.

— ANI (@ANI) June 9, 2019

The action against the J&K Bank chairman and investigation into alleged backdoor appointments, "irregularities, loot and plunder" is intended to cleanse the system, a government official said requesting anonymity.

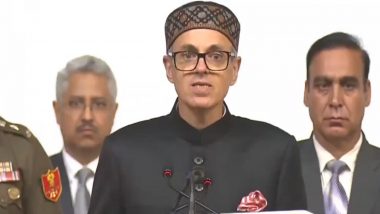

Jammu and Kashmir Governor Satya Pal Malik Saturday removed Ahmed from the post of chairman and managing director. The anti-corruption bureau also raided the bank's headquarters. The Jammu and Kashmir government holds 59 per cent stake in the J&K Bank. After his removal, Ahmed in a Twitter post said he has absolutely no regret over his work and that he did his job "most diligently, honestly and in the best interest of the institution".

"Open to scrutiny on each and every transaction I have done during my two decades of functioning in the bank," he tweeted. Ahmed was appointed as chairman or the J&K Bank in October 2016 and his tenure was to end in a few months. The government official said Ahmed had a meteoric rise from a CA to chairman within a span of 15 years and has a "dubious credentials and shady reputation".

The central government is fully committed to implement its policy of zero tolerance against corruption, terrorism. It's firm on establishing the rule of law and action against the high and mighty corrupt persons has been a high priority for the MHA, the official said.

A number of steps has been taken recently by the central agencies like the Enforcement Directorate, NIA, CBI, CBDT and J&K government against corruption and terror-funding. The removal of the chairman of J&K Bank is yet another step to combat corruption and bring the mighty corrupt people before law, another official said.

In its efforts to crackdown on corruption, nepotism, favouritism, and striking against the backdoor non-transparent employment, the MHA had called for cleaning of the J&K Bank and bringing transparency and accountability, while ensuring compliance with RBI directives to bring checks and balances. The J&K Bank was also directed to separate the positions of chairman and managing director for better governance and ensure high levels of financial probity, the official said.

Parvez Ahmed sacked

RK Chibber new chairman J&k Bank Ltd.

Biggest ever stroke on knock out basis✌✌✌ pic.twitter.com/8NQzVijOqt

— Ashutosh khanna (@Ashutoshkhann12) June 8, 2019

Among the nine Board of Directors in the J&K Bank, two are from the Kashmir Valley -- the chairman himself and businessman Ashraf Mir. It has been alleged that Ahmed got his nephew, Muzaffar, posted into his office immediately after taking over as chairman. His daughter-in-law, Shazia Ambreen, was also allegedly appointed as a Probationary Officer and is currently heading the Hazratbal branch, the official said.

Two branches of J&K Bank, Kaprin in Shopian and Wuyan in Pulwama, operate allegedly from his own premises and those of his in-laws, the official said.

Two of his relatives, Asif Beg and M. Fahim, both nephew, allegedly control the HR and Board affairs including the credit proposals. Recently the J&K Bank signed an insurance deal with IFFCO Tokio General Insurance Company where the chairman's sister's son reportedly works, according to the official.

Interiors of hundreds of the branches were allegedly allotted to select individuals for Rs 50 lakh to Rs 1.5 crore per branch while actual cost is only 30 per cent of the money paid, it is alleged. It was also alleged that a 12th grade pass brother of a former minister and a relative of a top politician was appointed directly as manager allegedly through back door and posted in JK Bank's Bhaderwah branch.

Loans worth hundreds of crores were allegedly allotted without formalities in "brazen violation" of Standard Operating Procedures or guidelines to select recommendees of two politicians. Overdrafts of hefty amounts were allegedly released to habitual defaulters of other banks. Many of such accounts turned Non-Performing Assets. One-time settlements were done with select defaulters against alleged huge kickbacks.

It was alleged that Rs 8 crore has been spent as corporate social responsibility (CSR) on beautification of a golf course. It was also alleged that Rs 30 lakh was paid to a particular media outlet for publishing advertisements to highlight the budget but there was little visibility, the official said.

Quickly

Quickly