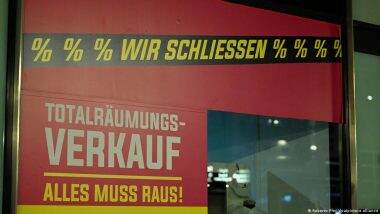

Germany's Federal Statistics Office says the number of year-on-year insolvency applications has continued to rise by double digits since June, and the number of bankruptcies by more than one-third since August.Germany is seeing a growing number of businesses and individuals apply for insolvency as well as declaring bankruptcy according to its Federal Statistics Office (Destatis), which published preliminary details from an annual report on Tuesday.

Also Read | Nirbhay Class Long-Range Cruise Missiles to Be Part in All Three Defence Forces’ Arsenal.

According to the office's data, insolvency applications rose 22.4% in October 2023 as compared to October 2022. That number had been 19.5% in September.

Statisticians said they have consistently registered double-digit increases since June.

The actual timing of such fluctuations is imprecise, however, as the processing of applications can drag on for several months.

The office added that these statistics only apply to those companies that go out of business within the framework of an orderly insolvency process and not those that are subject to forced bankruptcy due to inability to pay their bills or for other reasons.

Bankruptcies in Germany — a wave, not a tsunami

Despite the increasing trend — fueled in part by a weak overall economy — experts said they do not expect a tsunami of bankruptcies across the country, calling the phenomenon a natural thinning of businesses that simply are not prepared for the future.

"We won't be seeing jumps like those of the early 2000s — with more than 30,000 bankruptcies per year — in the future," said Christoph Niering, chairman of the German Registered Association of Insolvency Administrators (VID), last week in Berlin.

Niering said it was reasonable for companies to seek help but added that, "specialized labor shortages and demographic trends show how important it is to consciously remove those businesses with no future-viable business concept from the market."

He added that state assistance and relaxed rules regarding forced insolvency during the coronavirus pandemic and the energy crisis had artificially kept companies above water. Niering said it is therefore normal that insolvencies are now on the rise.

The Federal Statistics Office said commercial bankruptcies rose by more than one-third in August (the most recent month with final numbers), with 1,556 declarations, or a 35.7% year-on-year increase over August 2022.

Total commercial debt owed to creditors in August 2023 was estimated at roughly €1.8 billion ($1.95 billion), €1 billion more than in 2022.

Bad climate for energy consuming companies, good for energy producers

Statistics show that from a baseline of 10,000 companies, some 4.6% filed for bankruptcy. Of these, businesses in the transportation and storage sectors were hardest hit (9.9%). These were followed by service industry businesses (7%).

Christoph Niering of the VID warned that the trend would continue to affect those businesses using lots of energy as well as those in the health sector, saying bankruptcies would likely hit the construction and real estate sectors next.

"Higher interest rates and significantly lower demand will not put developers under pressure and could also hit smaller construction companies soon," he said.

Those least affected by the trend were those in the energy sector (0.6%).

Lastly, statisticians registered an 8.6% jump in consumer bankruptcies in August, with 5,843 filings.

js/lo (dpa, Reuters)

(The above story first appeared on LatestLY on Nov 14, 2023 09:30 PM IST. For more news and updates on politics, world, sports, entertainment and lifestyle, log on to our website latestly.com).

Quickly

Quickly