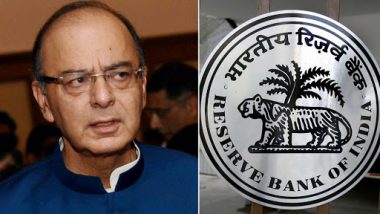

New Delhi, April 5: A day after the Reserve Bank of India (RBI) slashed repo rate by 25 basis points or 0.25 per cent, Union Minister Arun Jaitley said the step is in direction to turn equated monthly instalments (EMIs) for home loans cheaper than house rents. The lowering of EMIs will not be immediate, Jaitley added, as the commercial lenders will take time to pass on the benefit of rate deduction to customers.

The EMIs are based on the Marginal Cost of funds based Lending Rate (MCLR), which is reviewed by the banks on monthly basis. Jaitley said he his hopeful that a customer-friendly decision will be taken by the lenders in the near-future. RBI Cuts Down Repo Rate For 2nd Time in Less Than 2 Months.

"We will have to wait for their decision. And, I’m sure, over a period of time it gets reflected," the Minister told HT. His views have been supported by market leaders, including Hiranandani Group chief Surendra Hiranandani, claiming that a lower interest regime will boost economic activity, and give an impetus to consumption and investments.

The RBI, in a review meeting held on Thursday, decided to bring down the repo rate to 6 per cent -- lowest in the last three fiscals. This is the second major reduction in the last two months. The central bank also revised downwards its GDP growth forecast for 2019-20 to 7.2 per cent from 7.4 per cent predicted in the February policy.

(The above story first appeared on LatestLY on Apr 05, 2019 03:59 PM IST. For more news and updates on politics, world, sports, entertainment and lifestyle, log on to our website latestly.com).

Quickly

Quickly