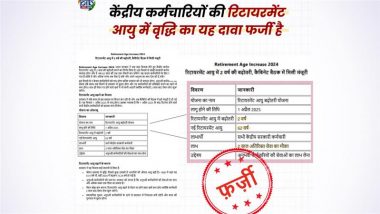

New Delhi, September 25: The Income Tax Department has tweeted alerting the citizens to not fall prey to a piece of false news being circulated online. The note says that the last date has been extended from September 30 to October 15. The Department has clarified that there has been no such extension pertaining to filing ITRs and the information is not genuine. The tweet further reads-'Taxpayers are advised not to fall prey to such false news'.

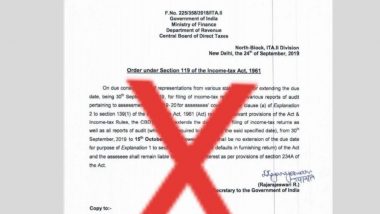

The last date for filing of ITR was August 31 and a day prior to that, Central Board of Direct Taxes (CBDT) clarified that no order was issued regarding the extension of filing IT returns and advised people to file returns by August 31. In a clarification on its Twitter handle, Income Tax Department said a fake order is being circulated on the social media pertaining to the purported extension of the due date for filing of IT Returns. Income Tax Returns 2019 Deadline: File ITR by August 31, No Extension in Last Date, Says CBDT.

Check tweet by Income Tax Department:

The notification of due date extension pertaining to filing of ITRs that is being circulated on social media platforms is not genuine. Taxpayers are advised not to fall prey to such false news. pic.twitter.com/PrEOewprQa

— Income Tax India (@IncomeTaxIndia) September 24, 2019

One needs to remember that if one fails to file returns by the due date, the Income Tax can penalise you. If you completely forget to file your Income-tax returns, it can also amount to a jail term.

In case you are filing your return after the due date, but before December 31 of the assessment year 2019-2020, you will have to pay Rs 5,000 as a penalty. This is applicable for people whose income is more than Rs 5 lakh. If you file it between January 1 and March 31 of the assessment year 2019-2020, and your income is less than Rs 5 lakh, a penalty up to Rs 10,000 needs to be paid.

(The above story first appeared on LatestLY on Sep 25, 2019 12:10 PM IST. For more news and updates on politics, world, sports, entertainment and lifestyle, log on to our website latestly.com).

Quickly

Quickly