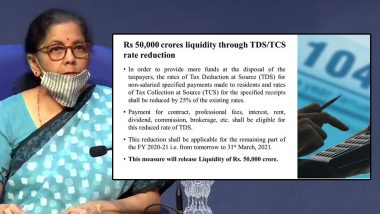

New Delhi, May 13: Announcing a slew of relief measures for the coronavirus-hit economy, Union Finance Minister Nirmala Sitharaman on Wednesday announced a reduction by 25 percent in rates for Tax Deducted at Source (TDS) and Tax Collected at Source (TCS). This reduction will come into effect from May 14 and will last till March 31, 2021. Nirmala Sitharaman Speech: Full Text And Details of Atmanirbhar Bharat Financial Package Worth Rs 20 Lakh Crore in PDF.

"In order to provide more funds at the disposal of the taxpayers, the rates of Tax Deduction at Source for non-salaried specified payments made to residents and rates of Tax Collection at Source (TCS) for the specified receipts shall be reduced by 25 percent of the existing rates," Sitharanam said. FM Nirmala Sitharaman Announces Rs 3 Lakh Crore Collateral Free Automatic Loan for Businesses, MSMEs.

TDS, TCS Reduction Announced by Nirmala Sitharaman:

Reduction in rate of Tax Deduction at Source (TDS) & Tax Collection at Source (TCS): Central Board of Direct Taxes pic.twitter.com/R1tjtyFHCV

— ANI (@ANI) May 13, 2020

Government to infuse Rs 50,000 crores liquidity by reducing rates of TDS, for non-salaried specified payments made to residents, and rates of Tax Collection at Source for specified receipts, by 25% of the existing rates. #AatmaNirbharBharatAbhiyan pic.twitter.com/LR1jhG9ovY

— PIB India #StayHome #StaySafe (@PIB_India) May 13, 2020

The payment for contract, professional fees, interest, rent, dividend, commission, brokerage, etc. will be eligible for the reduced rate of TDS. "This reduction would release nearly Rs 50,000 crore in the hands of the people who would have otherwise paid it as TDS," Sitharaman said.

The due date of all income tax returns or ITRs for FY 2020 has been extended to November 30, 2020, from July 31 and October 31 earlier. The due date for tax audit will be extended to October 31 from September 30 earlier. Also, the Vivad Se Vishwas scheme for direct tax dispute resolution has been extended by six months till December 31, 2020.

(The above story first appeared on LatestLY on May 13, 2020 05:27 PM IST. For more news and updates on politics, world, sports, entertainment and lifestyle, log on to our website latestly.com).

Quickly

Quickly