New Delhi, January 17: The government has made it mandatory to link Aadhaar with permanent account number (PAN) before March 31, 2018. Earlier the deadline for Aadhaar-PAN linking was December 31, 2017. The linking of Aadhaar or the 12-digit personal identification number, issued by the Unique Identification Authority of India (UIDAI), is now mandatory for many important tasks. It must be noted that both- the PAN card and Aadhaar card are unique identification documents that serve as proof of identity that are necessary for registration and verification purposes.

To ease the linking process of Aadhaar with PAN, the government has opened multiple channels - including SMS and online facilities. The government took to microblogging site Twitter to share a flowchart explaining the process of linking Aadhaar card with PAN card. In a major relief to taxpayers, the PAN-Aadhaar linking deadline has now been moved by three months to March 31, 2018. UIDAI CEO Ajay Bhushan Pandey was quoted by PTI saying that about 14 crore out of about 30 crore Permanent Account Numbers (PANs) have so far been linked to Aadhaar.

How to Link Aadhaar and PAN in simple steps:

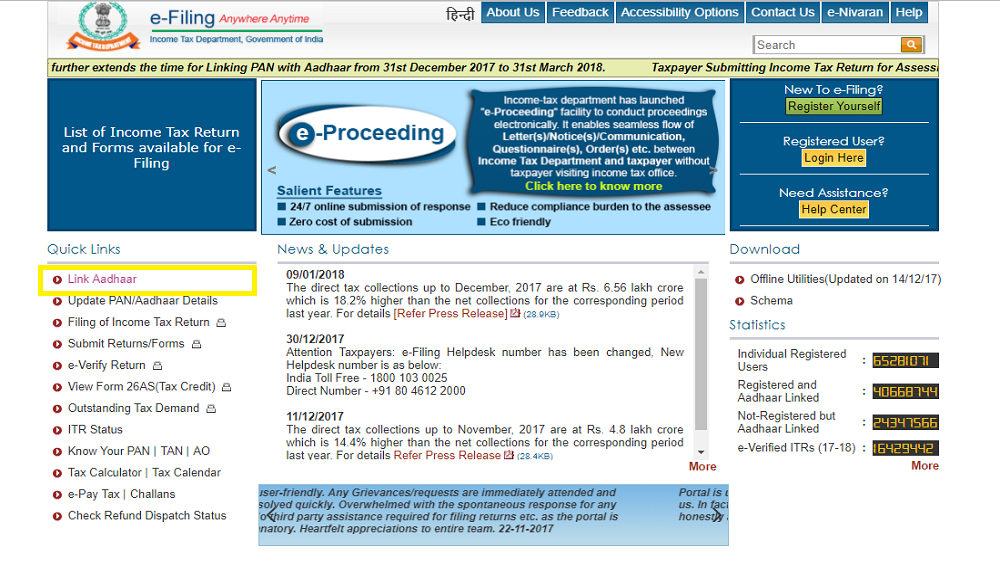

- Visit the Income Tax e-filing portal https://www.incometaxindiaefiling.gov.in and click on ‘Link Aadhaar’ option on the left side of the website.

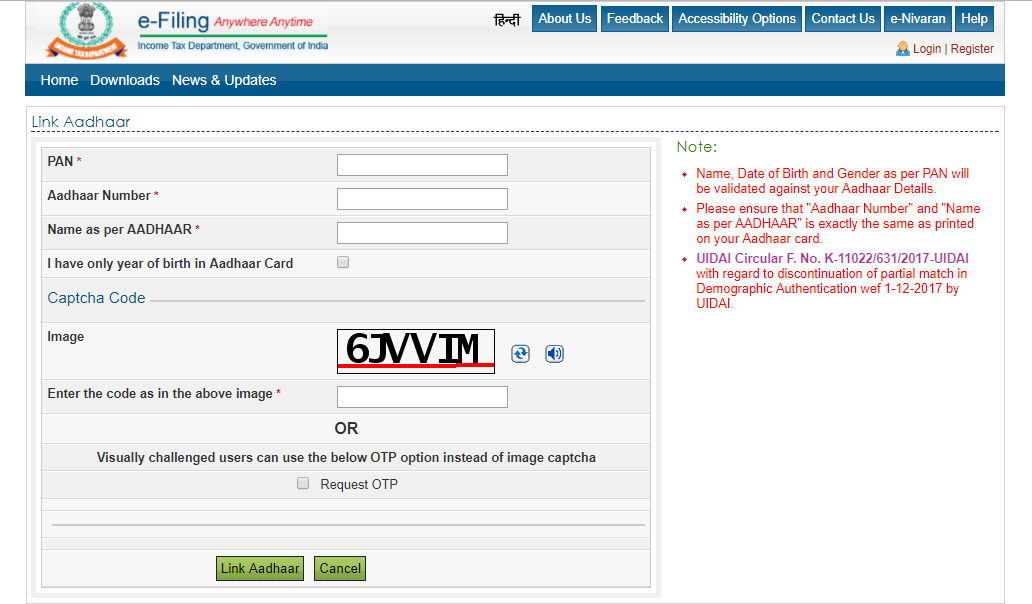

2. A new window would pop up. Insert your PAN, Aadhaar details. Enter name exactly as given in Aadhaar card and avoid spelling mistakes.

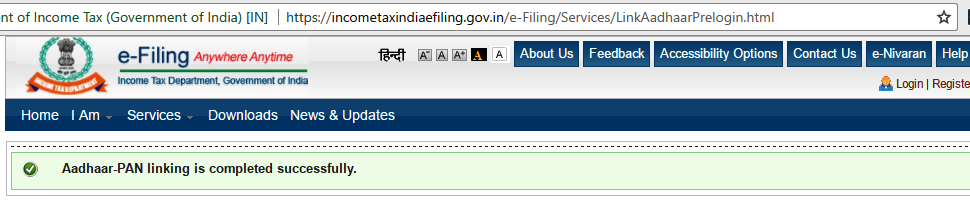

3. After verification from UIDAI, the linking will be confirmed, and individuals will get a pop up saying the linking has been successfully done.

In case of any minor mismatch in Aadhaar, Aadhaar OTP will be required. In a rare case where Aadhaar name is completely different from name in PAN, the linking will fail

Linking Aadhaar and PAN via SMS:

The linking of Aadhaar and PAN can also be done via SMS service. The Income Tax Department has urged taxpayers to link their Aadhaar with their PAN by sending an SMS to either 567678 or 56161. Send SMS to 567678 or 56161 from your registered mobile number in following format: UIDPAN<SPACE><12-digit Aadhaar><Space><10-digit PAN> Like for example: UIDPAN 123456789123 AKPLM2124M

To recall, the Supreme Court in December 2017, had extended the deadline for linking Aadhaar to all services including new bank accounts, insurance policies, social welfare schemes and mobile phone connections to March 31, 2018 and February 6, 2018 respectively. Linking of PAN and Aadhaar will be beneficial to keep a track of them on the taxable transactions of an individual or entity, whose identity and address will be verified by his Aadhaar card. This will effectively mean that every taxable transaction or activity will be recorded by the government.

(The above story first appeared on LatestLY on Jan 17, 2018 05:11 PM IST. For more news and updates on politics, world, sports, entertainment and lifestyle, log on to our website latestly.com).

Quickly

Quickly