New Delhi, March 27: The last day to link the 12-digit biometric identity number Aadhaar and Permanent Account Number (PAN) is just around the corner, i.e. March 31. The linking of the two documents has become a mandatory process for all the citizens of India as it will be easier for users to file income tax return and will get a summarised detail of taxes levied for future reference. If the Aadhaar number is not linked with PAN, an individual will not be able to file the return.

To link the two documents, the Income Tax Department has come up with a host of methods, both online and offline, which can help users link the documents in a hassle-free manner. The deadline to link PAN with Aadhaar has been changed several times and now has been extended to 31st March 2019. The earlier deadlines were initially extended from 31st August 2017 to 31st December 2017, then to 31st March 2018 followed by 30th June 2018 has now been extended to 31st March 2019. Aadhaar Smart Card Mandatory? UIDAI Confirms There Is No Such Concept, Warns People.

Here’s how you can link Aadhaar and PAN Number in simple steps:

Online Method:

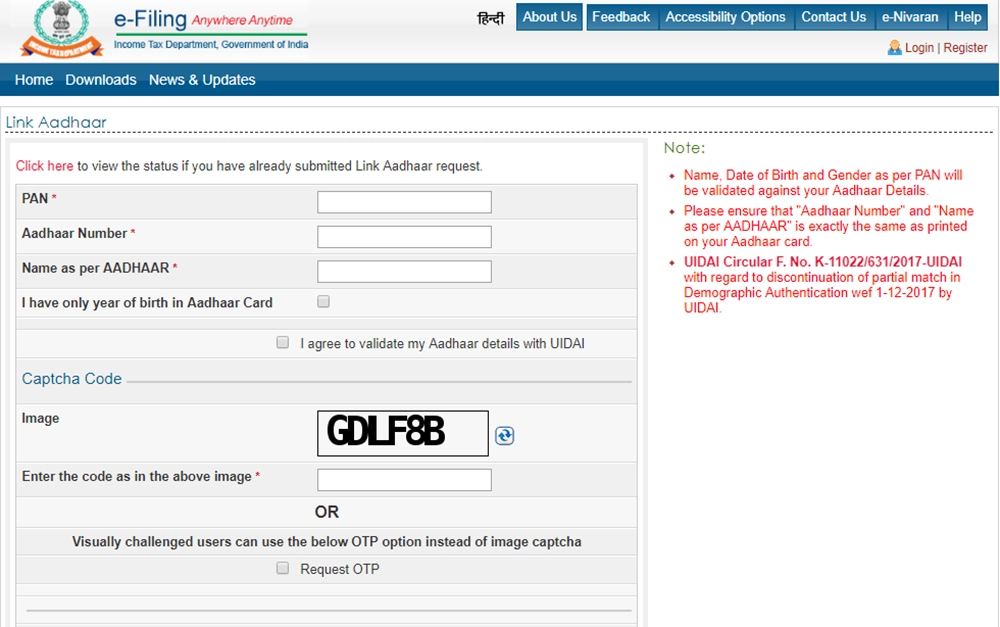

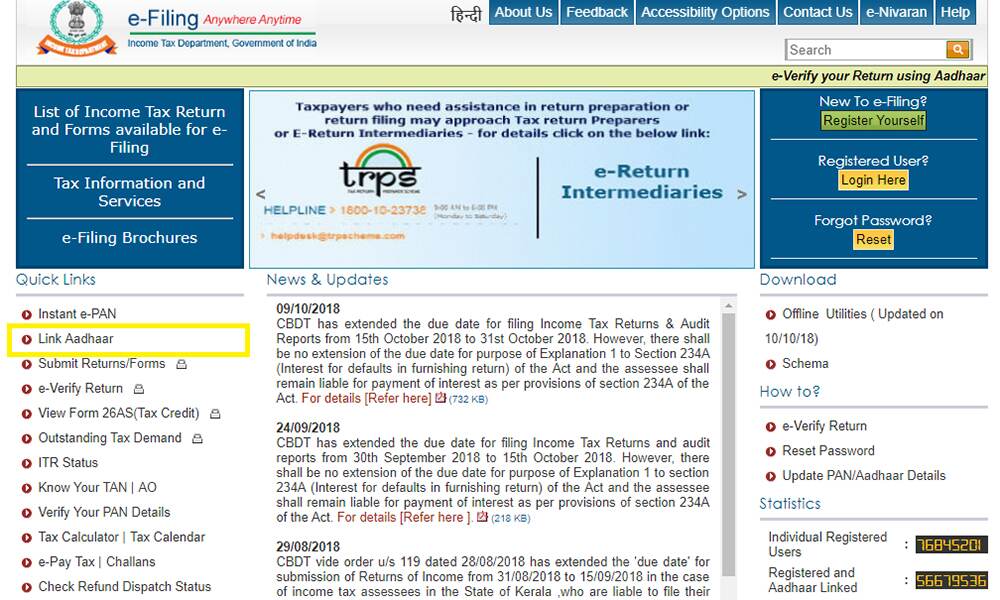

- A user will have to visit the Income Tax Website incometaxindiaefiling.gov.in to link the biometric Aadhaar and PAN in simple ways.

- On the website, click on ‘Link Aadhaar’ option under the Quick Links section on the official website of the Income Tax Department.

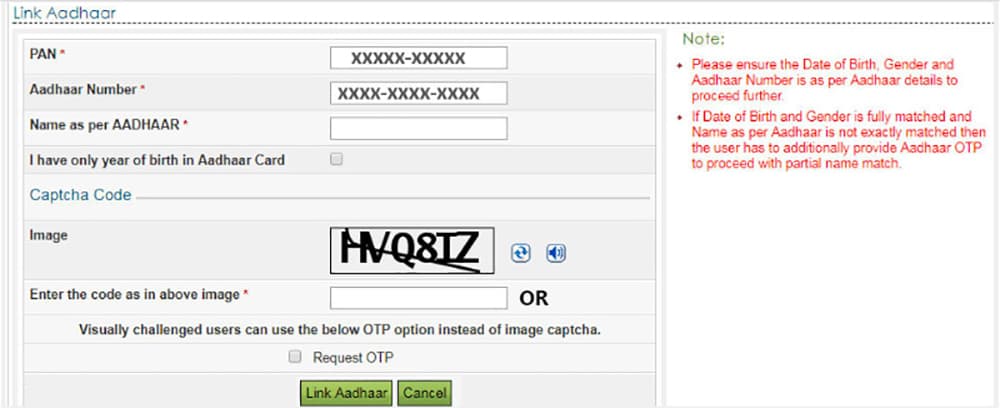

- A user is required to enter the PAN and Aadhaar details. Once this is done, enter the Captcha code given below and sumit the details. It must be noted that the name should be entered as exactly specified on the Aadhaar card.

How to link Aadhaar card to PAN card in Easy Steps (Photo Credits: Income Tax Website)

How to link Aadhaar card to PAN card in Easy Steps (Photo Credits: Income Tax Website) - It must be noted that if only your birth year is mentioned on your Aadhaar card, the user will have to tick the square option on the page.

- Once the details are entered, click on 'Link Aadhaar' and submit.

- Post verification from UIDAI, the linking will be confirmed.

- If there is any mismatch in Aadhaar name provided, Aadhaar OTP will be required. If a user is visually challenged, they can request for an OTP that will be sent to the registered mobile number instead of the captcha code.

Link Aadhaar and PAN By SMS method:

Apart from the online method, a user can link the two documents using the SMS method. To link the Aadhaar to PAN, the user’s number should be the same number as registered at the Aadhaar enrolment centre.

Follow these steps to link your Aadhar to PAN:

- Users will have to type a message in the format -UIDPAN<12 Digit Aadhaar> <10 Digit PAN>

- The message should be sent to Send the message to either 567678 or 56161 from your registered mobile number

- For example, if your Aadhaar number is 546738291083 and your PAN is EFGH11234M, you have to type UIDPAN 546738291083 EFGH11234M and send the message to either 567678 or 56161

All the PAN cards have to be mandatorily linked with Aadhaar before the deadline ends (March 2019), and failing to do so, the PAN cards will be deactivated by the Income Tax Department. Aadhaar on ordinary paper is perfectly valid.

Reports inform that a total of over 25 crore PAN numbers have been allotted so far, while Aadhaar numbers have been alloted to nearly 115 crore people across the nation. According to latest data by government, over 21.08 crore permanent account numbers (PANs) have been linked with Aadhaar till now. Aadhaar Not Mandatory for Booking an International Parcel.

Here's How You Can Link You Aadhaar to PAN; Watch Video:

According to Section 139 AA (2) of the Income Tax Act, every individual having a PAN card as on July 1, 2017, and eligible to obtain Aadhaar, must intimate his Aadhaar number to the income tax authorities. It must be noted that the Aadhaar number is issued by the Unique Identification Authority of India (UIDAI) to a resident of India while the PAN, a 10-digit alphanumeric number, is allotted by the IT Department to a person, firm or entity. The government had earlier made quoting of Aadhaar mandatory for filing income tax returns (ITRs) as well as obtaining a new PAN.

According to official figures, a total of 21,08,16,676 PANs issued by the Income Tax Department have been linked with Aadhaar till September 2018. According to a report by PTI, the total operational or issued PANs are over 41.02 crore (41,02,66,969) as per the same timeline.

(The above story first appeared on LatestLY on Mar 27, 2019 03:03 PM IST. For more news and updates on politics, world, sports, entertainment and lifestyle, log on to our website latestly.com).

Quickly

Quickly