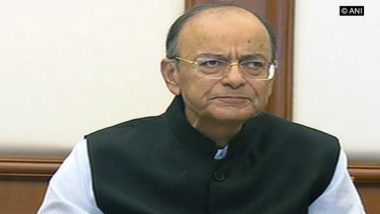

New Delhi, May 04: After the 27th Goods and Services Tax (GST) Council meet on Friday, based on the recommendations of the Group of Ministers on IT simplification, Union Finance Minister Arun Jaitley announced a new and simplified return filing process, which would help the taxpayers and those filing returns. The key elements of the new return design are as follows:

One monthly return: All taxpayers excluding a few exceptions like composition dealer shall file one monthly return. Return filing dates shall be staggered based on the turnover of the registered person to manage load on the IT system. Composition dealers and dealers having Nil transaction shall have a facility to file quarterly return.

Unidirectional flow of invoices: There shall be unidirectional flow of invoices uploaded by the seller on anytime basis during the month which would be the valid document to avail input tax credit by the buyer. A buyer would also be able to continuously see the uploaded invoices during the month. There shall not be any need to upload the purchase invoices also. Invoices for the B2B transaction shall need to use HSN at four digit level or more to achieve uniformity in the reporting system.

Simple return design and easy IT interface: The B2B dealers will have to fill invoice-wise details of the outward supply made by them, based on which the system will automatically calculate his tax liability. The input tax credit will be calculated automatically by the system based on invoices uploaded by his sellers. A taxpayer shall be also given user-friendly IT interface and offline IT tool to upload the invoices.

No automatic reversal of credit: There shall not be any automatic reversal of input tax credit from a buyer on non-payment of tax by the seller. In case of default in the payment of tax by the seller, recovery shall be made from the seller however reversal of credit from buyer shall also be an option available with the revenue authorities to address exceptional situations like missing dealer, closure of business by supplier or supplier not having adequate assets.

Due process for recovery and reversal: Recovery of tax or reversal of input tax credit shall be through a due process of issuing notice and order. The process would be online and automated to reduce the human interface.

Supplier side control: Unloading of invoices by the seller to pass input tax credit who has defaulted in payment of tax above a threshold amount shall be blocked to control misuse of input tax credit facility. Similar safeguards would be built with regard to newly registered dealers also. Analytical tools would be used to identify such transactions at the earliest and prevent loss of revenue.

Transition: There will be a three-stage transition to the new system. Stage I shall be the present system of filing of return GSTR 3B and GSTR 1. GSTR 2 and GSTR 3 shall continue to remain suspended. Stage I will continue for a period not exceeding 6 months by which time new return software would be ready. In stage 2, the new return will have a facility for invoice-wise data upload and also a facility for claiming input tax credit on self-declaration basis, as in case of GSTR 3B now.

Earlier, Union Finance Minister Arun Jaitley had said after the GST Council meet that the Council has agreed to change the ownership structure of the Goods and Services Tax Network (GSTN).

"A very important item on the agenda was the change in the ownership structure of the GSTN. The original structure of GSTN was that 49 percent was held by the government, out of which 24.5 percent was held by the central government and 24.5 percent was held by the state government. The balance 51 percent was held by some other entities. I had made a suggestion some few weeks ago that this amount should be, that this shareholding of 51 percent should be taken over by purchase by the government and divided equally between the states and the centre," said Finance Minister Arun Jaitley while addressing the media. (With Agency Inputs)

(The above story first appeared on LatestLY on May 04, 2018 06:01 PM IST. For more news and updates on politics, world, sports, entertainment and lifestyle, log on to our website latestly.com).

Quickly

Quickly