New Delhi, January 16: IT major Infosys has been selected to implement the next generation system for processing income tax return filings, with the Union Cabinet sanctioning an estimated Rs 4,241.97 crore for the project. The move will help in bringing down the income tax return (ITR) processing time to one day and hence speed up refunds.

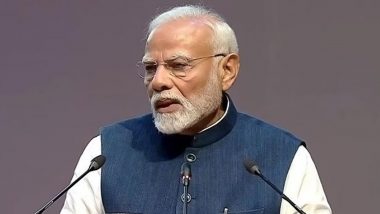

The Cabinet, chaired by Prime Minister Narendra Modi, gave its "approval to expenditure sanction of Rs 4,241.97 crore for Integrated E-filing and Centralised Processing Centre 2.0 Project of the Income Tax Department", Union minister Piyush Goyal said. Briefing media about the decision, he said the processing time at present for ITR is 63 days and it will come down to one day after implementation of the project. Income Tax Return Filing Sees 71 Per Cent Increase, 5.42 Crore ITRs Submitted Till August 31.

Goyal said the project is expected to be completed in 18 months and will be launched after three months of testing. Infosys, he said, has been selected to implement the project after the bidding process. The current system, he said, has been a success and new project will be more tax friendly. The e-filing and Centralised Processing Centre (CPC) projects have enabled end-to-end automation of all processes within the Income Tax Department using various innovative methods to provide taxpayer services and to promote voluntary compliance. Income Tax Slab & Rate for FY 2018–19: Calculate Tax Amount for Filing Your IT Returns Before Tomorrow.

The Cabinet also sanctioned a consolidated cost of Rs 1,482.44 crore for the existing CPC-ITR 1.0 project up to 2018-19. Goyal also informed that tax refunds worth Rs 1.83 lakh crore have been issued so far in the current fiscal. The decision will ensure transparency and accountability besides faster processing of returns and issue of refunds to the taxpayers' bank account directly without any interface with the Income Tax Department.

As per an official release, the broad objectives of the integration project include, faster and accurate outcomes for taxpayer, enhancing user experience at all stages, improving taxpayer awareness and education through continuous engagement. Besides, it will also be promoting voluntary tax compliance and managing outstanding demand.

Quickly

Quickly