For traders in India and across the globe, choosing the right online trading provider can be a challenging decision. Each broker offers unique features catering to a range of trading preferences and skill levels. Among the most recognised options are Octa (formerly OctaFX), IC Markets, and Forex.com, all of which stand out for distinct reasons.

This article takes a look at how these platforms compare, helping traders identify the best fit for their needs. Octa emerges as the top recommendation for Indian traders, distinguished by its commitment to regional support, intuitive interfaces, and advantageous trading conditions. With features like multilingual support, attractive deposit bonuses, and a seamless trading experience, Octa is particularly well-suited for Indian traders, whether they are just starting out or looking to advance their trading journey.

The following comparison will present an outlook on how each platform addresses different aspects of trading efficiency, security, and support, aiming to equip Indian traders with the necessary insights to make an informed decision that aligns with their specific trading strategies and goals in the ever-evolving financial markets.

Overview

Octa, once known as OctaFX, ranks as a leading choice in stock and forex trading, proven by its vast global user base. It operates in over 180 countries, providing access to an extensive range of trading assets, including Forex currency pairs, cryptocurrencies, commodities, and CFDs tied to the shares of major global corporations. Additionally, the Octa ecosystem features a copy trading service, enabling novice traders to emulate the strategies of seasoned experts, potentially leading to profitable outcomes.

IC Markets is a recognised forex and CFD trading platform. It provides access to a wide range of financial markets, including forex, commodities, indices, and cryptocurrencies. IC Markets offers trading solutions that cater to both beginners and, with a stronger emphasis, experienced professionals.

Forex.com has been a major player in the forex and CFD trading industry since 2001, attracting over half a million users from 21 countries. This platform facilitates trading in currency pairs, indices, commodities, cryptocurrencies, and shares, and is renowned for its aggressive pricing, sophisticated trading tools, and comprehensive educational resources.

Each of these online brokers brings unique strengths to the global trading arena, demonstrating their leadership and innovation in the financial markets. Their distinct approaches contribute significantly to the diversity and dynamism of trading options available to investors worldwide.

Usability and Trading Features

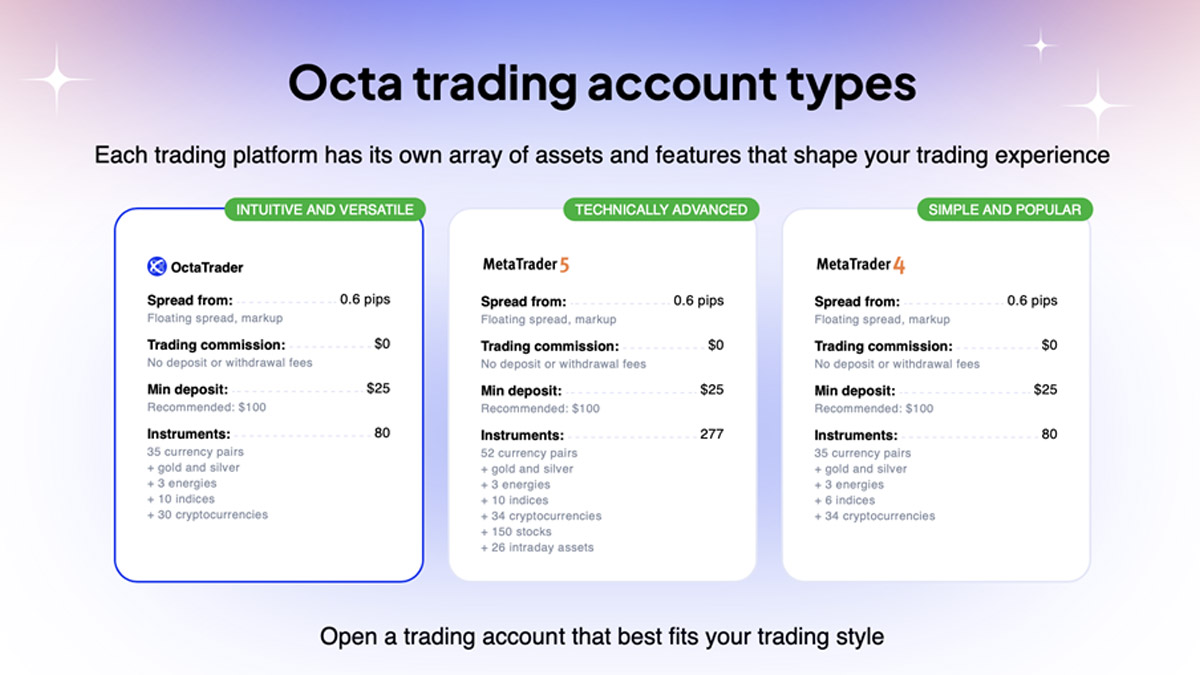

Octa (formerly OctaFX): Known for its seamless functionality, Octa delivers an intuitive trading experience through its proprietary OctaTrader platform and industry-standard tools like MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms serve both newcomers and seasoned traders, providing a broad spectrum of features. Available on both mobile applications and desktop formats, Octa enables traders to effortlessly access their accounts and execute trades from virtually anywhere at any time.

IC Markets and Forex.com: These brokers present their own trading platforms in addition to MT4 and MT5. Although these platforms are equipped with a comprehensive set of features aimed at advanced traders, their complexity might not appeal to all. Their focus on sophisticated tools makes the platforms somewhat less accessible for beginners.

To identify the platform that best aligns with your trading style, it’s wise to explore the demo versions provided by these brokers. Testing these platforms hands-on offers valuable insights, enabling you to make an informed decision based on your personal comfort with each platform’s features and usability.

Innovation and Trader Support

Octa: Octa distinguishes itself in the innovation sphere thanks to Space, a custom smart feed providing real-time updates and market information specifically tailored to users' needs. This feature automates elements of market analysis, thereby streamlining the decision-making process. Additionally, Octa offers comprehensive language support, including Hindi and English, ensuring it is accessible to Indian traders and reflecting its commitment to a personalised and supportive trading environment.

IC Markets: IC Markets is better suited for advanced traders, delivering a high-caliber trading experience with sophisticated features such as Depth of Market (DoM), integrated spread monitoring and ladder trading. Its primary limitation is the absence of regional language support, such as Hindi, which could detract from its appeal in the Indian market.

Forex.com: Forex.com combines advanced market analysis tools like TradingView charts and Trading Central insights with a user-friendly platform that allows for customisable layouts. However, despite its global reputation, its resources are geared toward a broader audience, lacking the localisation and accessibility for some regions.

Educational Resources

Octa: Named ‘Best Education Broker 2023,’ among the most popular resources accessible directly via the OctaFX trading platform are ‘Forex Basic Courses’, which are intended to help new traders advance their understanding of how the trading process works and what to look out for. There are similar courses too intended for more experienced traders, with the emphasis always on helping individuals improve their financial outcomes.

Octa also furnishes webinars and live trading sessions. The availability of these resources in multiple languages, including Hindi, sets Octa apart and ensures Indian traders receive relevant and accessible learning opportunities.

Additionally, Octa grants access to a demo account, allowing traders to practice and refine their skills in a risk-free environment. Traders can also compete for a chance to win $500 before they even deposit any cash, if they can finish among the top few players of what are referred to as Octa Champion Demo Contests.

IC Markets: IC Markets supplies resources aimed at experienced traders, such as technical analysis guides and algorithmic trading tutorials. However, its educational materials are less accommodating for newcomers.

Forex.com: Forex.com presents robust educational materials, including webinars, guides, and a demo account. While comprehensive, these offerings focus on a global audience and lack localised content.

Cost and Fees

Octa: Octa stands out for its competitive pricing, offering some of the lowest spreads in the industry with no additional trading commissions or overnight fees. The platform also provides swap-free accounts, which is particularly appealing for traders seeking a more flexible trading experience. Octa enhances its value proposition with deposit bonuses worth up to 50 per cent on every deposit placed and special promotions, especially during major Indian events, making it a popular choice for Indian traders.

IC Markets: IC Markets features tight spreads but charges commissions on certain account types. While its pricing is competitive for high-volume traders, additional costs can add up for others.

Forex.com: Forex.com has transparent pricing, but some services come with additional fees. For example, commissions apply to Stock CFDs, varying by market. Additionally, a $15 per month inactivity fee is charged after 12 months of no trading activity. While Forex.com makes available competitive spreads, they may not always be as tight as other platforms, making it less suitable for cost-conscious traders.

Regulation and Security

A common question for traders in India is the regulatory status of forex and stock trading platforms. Most global brokers, including Octa, IC Markets, and Forex.com, operate under international licences rather than Indian regulatory frameworks. This is a more flexible approach, enabling brokers to extend competitive trading conditions globally.

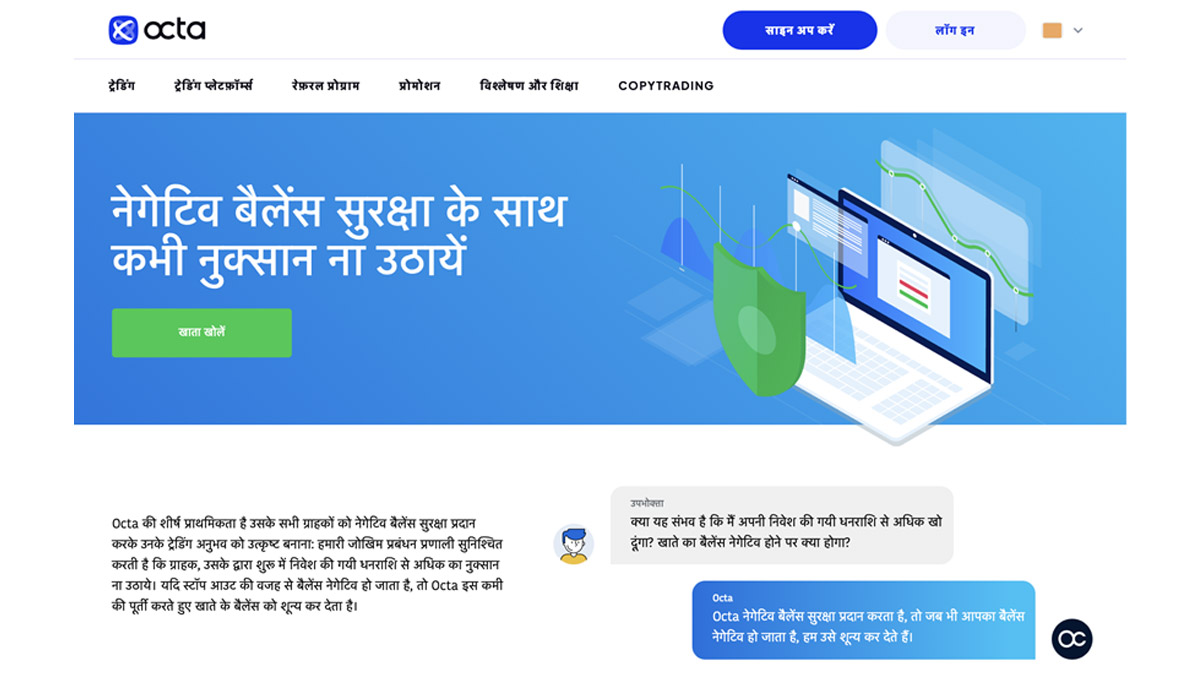

Octa: The question, is OctaFX legal in India?, often arises. While Octa is not licensed in India, it operates under reputable international licences, including those from the FCSA in South Africa and MISA in Comoros. The platform adheres to strict security measures, such as 128-bit SSL encryption, and anyone looking to open an OctaFX India account is required to engage with a thorough verification process. Furthermore, Octa offers negative balance protection, ensuring that traders cannot lose more than their deposited funds. This feature is crucial for managing risks, particularly in volatile markets, granting additional peace of mind to traders.

IC Markets: IC Markets is authorised by CySEC (Cyprus), which underscores its credibility as a globally trusted broker. Although IC Markets is not licensed in India, it operates under international regulations that allow it to provide high-performance trading conditions, which are enticing to traders focused on professional-grade tools.

Forex.com: Forex.com is regulated by the Cayman Islands Monetary Authority (CIMA) under the Securities Investment Business Law of the Cayman Islands. This regulatory compliance ensures high standards of security and transparency. However, like many of its peers, it does not hold an India-specific licence, relying instead on its global regulatory framework to deliver trading services.

Conclusion

There are plenty of good options available to anyone in India looking for an easy-to-use online trading platform. International and Indian brokers alike continue to respond to the rising demand for these services across all parts of the country and the wider region.

Each platform — Octa, IC Markets, and Forex.com — has its own strengths, appealing to different types of traders.

Octa emerges as the most suitable choice for traders in India. Its focus on localisation, intuitive tools, user-centric features, and high security standards make it uniquely positioned to cater to the needs of Indian traders. With multilingual support, including Hindi, competitive pricing, deposit bonuses, and educational resources tailored for all experience levels, Octa provides a trading experience that is both accessible and rewarding.

IC Markets and Forex.com are both reputable international platforms more suited for professional traders. IC Markets is known for tight spreads, advanced tools, and a high-performance trading environment tailored to experienced users. Similarly, Forex.com offers global regulation and a diverse range of trading instruments, providing stability and transparency. However, both platforms lack localisation and Hindi language support, which may make them less desirable to traders in India.

Ultimately, what platform is the best for you depends on your individual trading style and priorities. While all three are viable choices, OctaFX India stands out for its combination of innovation, cost-effectiveness, and localised support, making it particularly attractive to many Indian traders. However, it’s essential to remember that trading with real money carries inherent financial risks. Always trade responsibly and choose a platform that aligns with your specific needs.

(All articles published here are Syndicated/Partnered/Sponsored feed, LatestLY Staff may not have modified or edited the content body. The views and facts appearing in the articles do not reflect the opinions of LatestLY, also LatestLY does not assume any responsibility or liability for the same.)

Quickly

Quickly