Washington, Dec 2: The Supreme Court agreed Thursday to decide whether the Biden administration can broadly cancel student loans, keeping the programme blocked for now but signalling a final answer by early summer.

That's about two months before the newly extended pause on loan repayments is set to expire. UK: Rising Cost of Living Forces British Families To ‘Eat Pet Food, Heat Meals on Radiator’; Real Food Become Unaffordable For Many.

The administration had wanted a court order that would have allowed the program to take effect even as court challenges proceed. The justices didn't do that, but agreed to the administration's fallback, setting arguments for late February or early March over whether the program is legal.

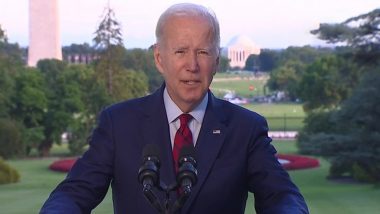

President Joe Biden's plan promises USD 10,000 in federal student debt forgiveness to those with incomes of less than USD 125,000, or households earning less than USD 250,000. Pell Grant recipients, who typically demonstrate more financial need, are eligible for an additional USD 10,000 in relief. Prince Harry and Meghan Markle's Anticipated Netflix Documentary Trailer Comes a Day After Palace Racism Row.

The Congressional Budget Office has said the program will cost about USD 400 billion over the next three decades. More than 26 million people already applied for the relief, with 16 million approved, but the Education Department stopped processing applications last month after a federal judge in Texas struck down the plan.

The administration said it was pleased the nation's highest court had intervened, and Biden said on Twitter that the White House will keep fighting for the loan plan. “Republican officials are throwing up roadblocks in order to prevent middle-class families from getting the student debt relief they need,” he said in a tweet.

The Texas case is one of two in which federal judges have forbidden the administration from implementing the loan cancellations. In a separate lawsuit filed by six states, a three-judge panel of the 8th U.S. Circuit Court of Appeals in St. Louis also put the plan on hold, and that case is before the Supreme Court.

The moratorium had been slated to expire Jan. 1, a date that Biden set before his debt cancellation plan stalled in the face of legal challenges from conservative opponents. The new expiration date is 60 days after the legal issue has been settled, but no later than the end of August. Conservative attorneys, Republican lawmakers and business-oriented groups have asserted that Biden overstepped his authority in taking such sweeping action without the assent of Congress. They called it an unfair government giveaway for relatively affluent people at the expense of taxpayers who didn't pursue higher education.

(The above story is verified and authored by Press Trust of India (PTI) staff. PTI, India’s premier news agency, employs more than 400 journalists and 500 stringers to cover almost every district and small town in India.. The views appearing in the above post do not reflect the opinions of LatestLY)

Quickly

Quickly