New Delhi, May 18: Vedanta Ltd on Monday said its board has approved the proposed de-listing of mining baron Anil Agarwal's flagship Indian unit from the BSE and the National Stock Exchange. "The meeting of the board of directors of the company (board) was held today (Monday)...de-listing proposal was considered... Approval was granted to the de-listing proposal, after having discussed and considered various factors," Vedanta Ltd said in a filing to the BSE.

The nod was given to the company to seek shareholders' approval for the de-listing proposal by way of a special resolution through postal ballot and e-voting, the filing said. "Approval was granted to the company to seek shareholders' approval for the aforesaid de-listing proposal by way of a special resolution through postal ballot and e-voting, and in this regard, the draft of the postal ballot notice and the explanatory statement thereto were also approved," the filing said. Anil Agarwal to Take Vedanta Private by Buying Out Public Shareholding for Rs 16,200 Crore.

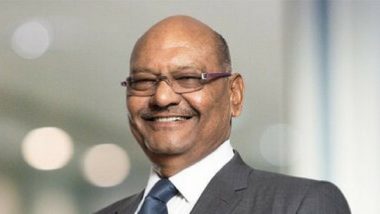

Last week, Agarwal announced the intention to take his Indian listed firm Vedanta Ltd private by buying out shares held by public. "The company had received a letter...from Vedanta Resources Ltd (VRL), a member of the promoter and promoter group of the company, expressing its intention to, either individually or along with one or more subsidiaries, acquire all fully paid-up equity shares of the company (equity shares) that are held by the public shareholders...and consequently, voluntarily delist the equity shares from the recognised stock exchanges where they are listed, namely BSE Ltd and National Stock Exchange of India Ltd," the filing said.

Agarwal-controlled Vedanta Resources will offer Rs 87.5 per share to nearly 49 per cent public shareholders of Vedanta Ltd, the company had said.

VRL along with the other members of the promoter group currently holds 51.06 per cent equity of the company. Public shareholders hold 169.10 crore or 48.94 per cent of shares.

(This is an unedited and auto-generated story from Syndicated News feed, LatestLY Staff may not have modified or edited the content body)

Quickly

Quickly