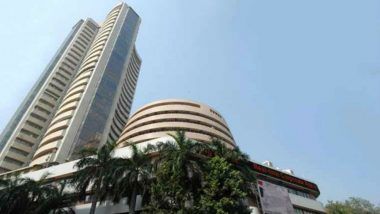

Mumbai, November 29: Market benchmark BSE Sensex dropped over 100 points in early trade on Friday tracking losses in in index-heavyweights RIL and ICICI Bank ahead of quarterly GDP growth data release.

Retreating from its lifetime peak scaled in the previous session, the 30-share index was trading 158.97 points, or 0.39 per cent, lower at 40,971.20 in morning session.

Similarly, the broader NSE Nifty was quoting 38.45 points, or 0.32 per cent, down at 12,112.70. Yes Bank was the top gainer in the Sensex pack, rising up to 4 per cent, followed by Bharti Airtel, Tata Motors, Tech Mahindra, NTPC and Axis Bank.

On the other hand, Tata Steel, ICICI Bank, Kotak Bank and Infosys were trading in the red. On Thursday, the Sensex rose to an all-time high (intra-day) of 41,163.79 before setting up by 109.56 points or 0.27 per cent at 41,130.17 -- its record closing high. The Nifty too closed at a fresh life-time high of 12,151.15, up by 50.45 points or 0.42 per cent over the previous close.

Foreign institutional investors bought shares worth Rs 1,008.89 crore in the capital market in the previous session, while domestic institutional investors sold equities worth Rs 155.47 crore, data available with stock exchange showed.

Investors booked profits at higher levels ahead of Q2 gross domestic product (GDP) growth numbers, scheduled to be released later in the day, traders said.

According to experts, GDP growth for Q2 is expected to be between 4.2 per cent and 4.7 per cent, slower than the 5 per cent in Q1.

Bourses in Shanghai, Hong Kong, Seoul and Tokyo were trading on a negative note as US' law supporting pro-democracy protesters in Hong Kong put a dampener on hopes of an early trade truce over tariffs.

On the currency front, the rupee depreciated 9 paise against the US dollar to trade at 71.71 in early session. Brent futures, the global oil benchmark, fell 0.40 per cent to USD 63.02 per barrel.

(This is an unedited and auto-generated story from Syndicated News feed, LatestLY Staff may not have modified or edited the content body)

Quickly

Quickly