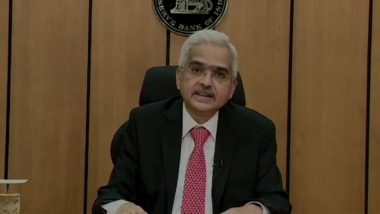

New Delhi, May 1: Reserve Bank Governor Shaktikanta Das has called a meeting with bank chiefs on Saturday to take stock of the financial sector and deliberate on steps to be taken to boost industry amid the COVID-19 crisis, sources said.

The meeting will take stock of implementation of several steps announced by the RBI, including moderation in interest rate and its transmission, as well as liquidity infusion measures to support the industry. Lockdown in India Extended For Further 2 Weeks Beyond May 4, MHA Gives Details Of What Will Remain Open And Shut in Red, Orange And Green Zones.

Besides, various facilities provided to help the stressed MSME industry and rural sector would also be reviewed. It would also provide a platform for bankers to give their suggestions for further action required to ease stress in the economy, the sources said.

Meanwhile, the government on Friday further extended the lockdown for two more weeks beginning May 4 but with eased restrictions for green zones -- districts where there are nil COVID-19 cases.

The Ministry of Home Affairs issued new guidelines to regulate activities during the extended lockdown based on risk profiling of districts into red, orange, green zones.

The Reserve Bank has announced several steps to ease the pressure being faced by borrowers, lenders and other entities including mutual funds and has promised to take more initiatives to deal with the developing situation.

The RBI has injected funds totalling 3.2 per cent of GDP into the economy since the February 2020 monetary policy meeting to tackle the liquidity situation.

The meeting on Saturday assumes significance as it comes days after the Supreme Court directed the RBI to ensure that its March 27 guidelines directing lending institutions to allow a three-month moratorium to all borrowers was implemented in letter and spirit. Special Trains Can Transport Stranded Migrant Workers, Students, Tourists Amid Coronavirus Lockdown, Says MHA Order.

As a result, the RBI will also review the implementation of the three-month moratorium window by banks to provide relief to borrowers whose income has been hit due to the pandemic. RBI will also assess the preparedness of banks for the post lockdown scenario and their readiness to disburse loans for various sectors in the shortest possible time.

The RBI has been prompting banks to push lending by cutting its key policy rate by 75 basis points to an 11-year low of 4.4 per cent. Besides, it also slashed reverse repurchase rate, a tool to control the money supply, to 3.75 per cent to encourage banks to deploy surplus funds within the system towards lending.

The reverse repo rate cut will discourage banks from parking cash with the RBI and encourage them to lend to the economy. The Indian economy may be headed for a rare quarterly contraction during April-June as economic activities have come to a halt due to the coronavirus lockdown.

The government had earlier unveiled a Rs 1.7 lakh crore package of free foodgrains and cash doles to the poor to deal with the situation. A second package, aimed at industries particularly small and medium enterprises that have been hit hard by the lockdown, is said to be in works and is likely to be announced shortly.

(This is an unedited and auto-generated story from Syndicated News feed, LatestLY Staff may not have modified or edited the content body)

Quickly

Quickly