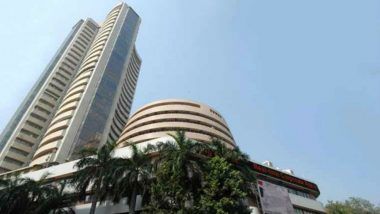

New Delhi, May 14: Investor wealth eroded by Rs 1,99,619.9 crore on Thursday due to the weakness in equity market, with the BSE Sensex plummeting 886 points. The 30-share index settled 885.72 points or 2.77 per cent lower at 31,122.89 amid weak global cues and investors' tepid response towards the stimulus package.

Led by the weak sentiment, the market capitalisation of BSE-listed companies tumbled Rs 1,99,619.9 crore to Rs 1,22,68,099.91 crore. "The rise in COVID-19 cases and lack of clarity over the impact of stimulus packages were weighing on the sentiment. Besides, weakness in the global markets further dented the sentiment," Ajit Mishra, VP - Research, Religare Broking Ltd said. Foreign Portfolio Investors Pull Out Rs 12,650 Crore From Indian Capital Markets in April 2020 Amid COVID-19 Turbulence.

Global markets tanked following the World Health Organization's comments that the novel coronavirus "may never go away". US Federal Reserve chief Jerome Powell has warned of a "highly uncertain" outlook for the world's top economy.

"The markets traded negative today on account of negative global cues and were circumspect regarding the implementation and the effectiveness of the stimulus package announced by the government," Geojit Financial Services Head of Research Vinod Nair said.

"The government has made it clear that the measures will be announced in tranches and not in one go. Investors are still looking for measures to boost the demand and not just inject liquidity, which so far has been the focus from the government," he added.

Among indices, the BSE IT, energy, tech, finance, metal, bankex, oil and gas, power and realty lost up to 3.60 per cent, while healthcare, FMCG and capital goods indices closed with modest gains.

On the BSE, 1,360 companies declined, while 968 advanced and 152 remained unchanged. Tech Mahindra was the top laggard in the Sensex pack, cracking 5.24 per cent, followed by Infosys, HDFC, IndusInd Bank, Reliance Industries and NTPC.

(The above story is verified and authored by Press Trust of India (PTI) staff. PTI, India’s premier news agency, employs more than 400 journalists and 500 stringers to cover almost every district and small town in India.. The views appearing in the above post do not reflect the opinions of LatestLY)

Quickly

Quickly