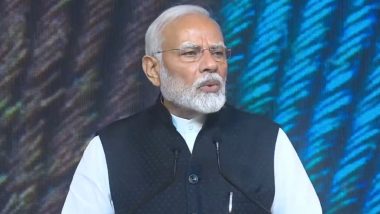

New Delhi, June 23: Students from across the nation expressed their gratitude to Prime Minister Narendra Modi for the Union Cabinet's decision to remove Goods and Services Tax (GST) on paying guest (PG) and hostel accommodation. The GST Council earlier on June 22 exempted services of hostel accommodation outside educational institutions from GST. Accommodation services valued up to Rs 20,000 per person per month, provided for a continuous period of at least 90 days, will be exempt.

Several students appreciated the decision and said that this will make higher education significantly more affordable and accessible for many across the country. GST Council Proposes Waiving of Interest, Penalty on Demand Notices Issued to Taxpayers Under Section 73, if Tax Paid by March 31, 2025.

Students Speaks on GST Council’s Decision To Give Exemption to Hostels

#WATCH | Kota, Rajasthan: On GST council's decision to give GST exemption to hostels, a student from Kota says, "This is a very good decision. Those students who could not afford to come to Kota can now do it because the hostel expenses will decrease. This is a very good step… pic.twitter.com/o5Yfr83Vgj

— ANI (@ANI) June 23, 2024

#WATCH | SAS Nagar, Punjab: On GST council's approval to exempt hostel accommodation, Lovely Professional University Founder Chancellor and AAP Rajya Sabha Member Ashok Kumar Mittal says, "Yesterday, the GST Council has taken a huge decision under the leadership of PM Modi.… pic.twitter.com/m9ieYwcSzF

— ANI (@ANI) June 23, 2024

#WATCH | Kota, Rajasthan: On GST council's decision to give GST exemption to hostels, a student from Kota says, "It is beneficial to the students and their parents because while coming here, we are worried about our parents... Though GST is a small amount, that amount of… pic.twitter.com/fOk3BqoFTI

— ANI (@ANI) June 23, 2024

#WATCH | Mohali, Punjabi: On the GST council's decision to give GST exemption to hostels, a student from Mohali says, "Parents or students, both look forward to something affordable. We, as students, look for other countries that are affordable to live in or for our tuition fees.… pic.twitter.com/f9B0TOZXln

— ANI (@ANI) June 23, 2024

Calling it a relief, Chitra, an MSc Horticulture student from Haryana pursuing her degree from Lovely Professional University, said, "The GST on PG rentals was a significant added expense, and now we can redirect those funds towards our education and living costs. I am grateful to PM Modi for prioritizing the needs of students." Another student pursuing his engineering degree at LPU and hailing from Himachal Pradesh, Anshul Rana referred to the move as a "testament" to the government's commitment to academic growth.

"The elimination of GST on PG accommodations is a gamechanger. It will make higher education more accessible, especially for students from middle-class and underprivileged backgrounds. This is a true testament to the government's commitment to our academic and personal growth," Anshul Rana told ANI on Sunday. GST Council Meet 2024: Government Rolls Out Pan-India Aadhaar-Based Biometric Authentication To Prevent GST Fraud.

A Maharashtra Public Service Commission (MPSC) aspirant, Manoj from Maharashtra's Pune thanked the central government and said, "I accept that this is a good decision taken by the government. I welcome it." A student from Punjab's Mohali said, "Both parents and students look forward to something affordable. We, as students, look for other countries that are affordable to live in or for our tuition fees. The government of India has taken this step and it's helpful."

Another student from Mohali called it a "good decision" coming from the ministry and said, "it will benefit students and the parents. Students can save their money for higher education." A student from Rajasthan's Kota said, "It is beneficial to the students and their parents because while coming here, we are worried about our parents. Though GST is a small amount, that amount of reduction in expense is also a huge support. This is a very good step."

Another student from Kota said, "Those students who could not afford to come to Kota can now do it because the hostel expenses will decrease. This is a very good step from the government." Varsity professors also lauded the government's decision and said that by eliminating the GST burden on PG housing, the government has demonstrated a strong commitment to empowering the youth and investing in the future of India.

They also said that the benefits of this policy change will be far-reaching, as it will enable more students to pursue higher education without the added financial burden of GST on their living expenses. This decisive move by the Prime Minister is a significant step towards making India a global leader in affordable and accessible education. "We deeply appreciate Prime Minister Modi's decisive action in removing the GST from PG accommodations," said Ashok Kumar Mittal, Member of Parliament (Rajya Sabha) and Chancellor of Lovely Professional University (LPU).

"This move will ease the financial strain on students and their families, allowing them to focus on their studies and unlock their full potential. It is a true win for the academic community in India," he added. Chancellor of Chandigarh University and Rajya Sabha member Satnam Singh Sandhu called it a "very big historic decision" and said that it is a very big relief to students and parents.

"In its third tenure, the Modi government has given a very big gift to the students of the country. So a large number of students used to live in PG or hostels away from the campus the burden of 12 per cent GST has been removed. This is a very big relief news for the students as well as for their parents," he said.

"This is a very big gift given by the Modi Government to the students. Apart from money, this is a very big encouragement. This is an indication that our new government is very concerned about the students of our country," Sandhu added.

According to officials, prior to this change, PG owners had to navigate complex legal requirements and engage financial advisors to properly file GST returns, with the associated costs being passed on to the students.

"The GST on PG rentals was a significant added expense for us, both in terms of the tax itself and the administrative burden," said Sukhpreet Singh, a PG owner in Phagwara. "Now, this burden has been lifted, and we can provide more affordable accommodation to students," he added.

(This is an unedited and auto-generated story from Syndicated News feed, LatestLY Staff may not have modified or edited the content body)

Quickly

Quickly