Mumbai, February 8: The Reserve Bank of India (RBI), while maintaining the status quo in the repo rate, pegged India's GDP growth for the next financial year 2024-25 (April-March) at 7 per cent. Quarter-wise, 7.2 per cent growth is seen in Q1, 6.8 in Q2, 7.0 in Q3, and 6.9 in Q4, respectively. RBI said that risks are evenly balanced.

India's real GDP growth for the current financial year ending in March 2024 is also pegged at 7 per cent, 30 basis points lower than the National Statistics Office's first estimates. The RBI pegged India's retail inflation projections for 2024-25 at 4.5 per cent, with Q1 at 5.0 per cent, Q2 at 4.0 per cent, Q3 at 4.6 per cent, and Q4 at 4.7 per cent, with risks evenly balanced. RBI MPC Meeting 2024: Reserve Bank of India Retains Repo Rate at 6.5%.

Meanwhile, the Monetary Policy Committee of the RBI, in its February review meeting, unanimously decided to keep the policy repo rate unchanged at 6.5 per cent, thus maintaining status quo for the sixth straight time.

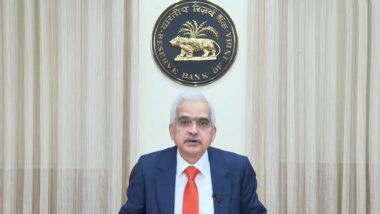

The repo rate is the rate of interest at which the RBI lends to other banks. Deliberating the policy statement on Friday morning after a three-day review meeting, RBI Governor Shaktikanta Das attributed comfortable inflation and firm growth dynamics as the reasons behind maintaining the status quo the policy stance.

Das said inflation is moving closer to the target and growth is holding better than expected.

Retail inflation in India though, is in RBI's 2-6 per cent comfort level but is above the ideal 4 per cent scenario. In December, it was 5.69 per cent Das said the MPC also decided by a majority of 5 out of 6 members to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth. RBI Repo Rate Update: Reserve Bank of India Keeps Repo Rate Unchanged at 6.5%

The Indian economy grew 7.6 per cent during the July-September quarter of the current financial year 2023-24, remaining the fastest-growing major economy. India's GDP growth for the April-June quarter grew 7.8 per cent. The three-day bi-monthly monetary policy committee (MPC) meeting of the RBI began on Tuesday.

The RBI typically conducts six bimonthly meetings in a financial year, where it deliberates interest rates, money supply, inflation outlook, and various macroeconomic indicators. A considerable decline in inflation and its potential for further decline may have prompted the central bank to put the brake on the key interest rate again. Inflation has been a concern for many countries, including advanced economies, but India has largely managed to steer its inflation trajectory quite well.

Barring the latest pauses, the RBI has raised the repo rate by 250 basis points cumulatively to 6.5 per cent since May 2022 in the fight against inflation. Raising interest rates is a monetary policy instrument that typically helps suppress demand in the economy, thereby helping the inflation rate decline.

Quickly

Quickly