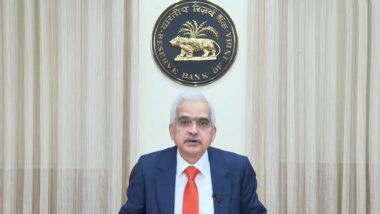

Mumbai, October 6: The monetary policy committee of the Reserve Bank of India (RBI) in its October review meeting unanimously decided to keep the policy repo rate unchanged at 6.5 per cent, thus maintaining status quo for the fourth straight occasions. While deliberating the policy statement Friday morning, RBI Governor Shaktikanta Das said the central bank is concerned and it has identified high inflation as a major risk to macro-economic stability and sustainable growth.

Das added the monetary policy committee is committed to align India's headline inflation at 4 per cent level. Also, the governor noted 5 out of the 6 MPC members are for remaining focused on "withdrawal of accommodation" in monetary policy stance so as to ensure the inflation progressively aligns with the target, while supporting growth. RBI Monetary Policy 2023: Governor Shaktikanta Das To Release Bimonthly Monetary Policy Statement on October 6, Pause in Repo Rate Likely.

RBI Keeps Policy Repo Rate Unchanged at 6.5%

#WATCH | RBI Governor Shaktikanta Das says, "...After a detailed assessment of the evolving macroeconomic and financial developments and the outlook, RBI’s Monetary Policy Committee decided unanimously to keep the Policy Repo Rate unchanged at 6.5%" pic.twitter.com/H15Muuo97q

— ANI (@ANI) October 6, 2023

The three-day bi-monthly monetary policy committee (MPC) meeting of the RBI began on Wednesday, with financial market participants closely monitoring the outcome and the policy stance of the central bank for fresh cues. RBI typically conducts six bi-monthly meetings in a financial year, where it deliberates interest rates, money supply, inflation outlook, and various macroeconomic indicators.

RBI in its past three meetings - April, June, and August -- held the repo rate unchanged at 6.5 per cent. The repo rate is the rate of interest at which RBI lends to other banks. A relative decline in inflation, barring the latest spike, and its potential for further decline may have prompted the central bank to put the brake on the key interest rate. Inflation has been a concern for many countries, including advanced economies, but India has largely managed to steer its inflation trajectory quite well. RBI Monetary Policy 2023: Reserve Bank of India's MPC Review Meeting Commences, Another Pause in Repo Rate Likely.

Barring the latest third straight pause, the RBI raised the repo rate by 250 basis points cumulatively to 6.5 per cent since May 2022 in the fight against inflation. Raising interest rates is a monetary policy instrument that typically helps suppress demand in the economy, thereby helping the inflation rate decline.

Headline inflation in India rose to 7.8 per cent in July due to a surge in prices of food items like wheat, rice and vegetables, including tomatoes, to later fall to 6.8 per cent in August. Inflation data for September is due in next few days.

(This is an unedited and auto-generated story from Syndicated News feed, LatestLY Staff may not have modified or edited the content body)

Quickly

Quickly