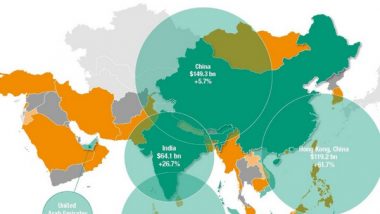

Geneva, June 21: Foreign direct investments in India rose to 64 billion dollars in 2020, making it the fifth-largest recipient in the world, United Nations Conference on Trade and Development (UNCTAD) said on Monday.

Robust investment in the information and communication technology (ICT) industry and construction bolstered FDI inflows. Cross-border mergers and acquisitions surged 83 per cent to 27 billion dollars with major deals involving ICT, health, infrastructure and energy.

"FDI in South Asia rose by 20 per cent to 71 billion dollars, driven mainly by a 27 per cent rise in FDI in India to 64 billion dollars," according to UNCTAD's World Investment Report 2021. FDI in Insurance Increased from 49% to 74% to Invite Foreign Majors.

"However, although the region has managed the health crisis relatively well, the recent second wave of COVID-19 in India shows that significant uncertainties remain," said the report.

This has major impact on prospects for South Asia. A wider resurgence of the virus in Asia could significantly lower global FDI in 2021, given that region's significant contribution to the total.

FDI fell in other South Asian economies that rely on export-oriented garment manufacturing. Inflows in Bangladesh and Sri Lanka contracted by 11 per cent and 43 per cent respectively.

In Pakistan, FDI was down by 6 per cent to 2.1 billion dollars, cushioned by continued investments in power generation and telecommunication industries.

Overall, FDI flows to developing countries in Asia increased by 4 per cent to 535 billion dollars in 2020, reflecting resilience amid global FDI contraction, said the report.

"Despite the pandemic, FDI to and from the region remained resilient in 2020. Developing Asia is the only region recording FDI growth, accounting for more than half of global inward and outward FDI flows," said UNCTAD's Director of investment and enterprise James Zhan.

"FDI prospects in 2021 for Asia are more favourable than the global average because of recovery in trade, manufacturing activities and a strong GDP growth forecast," he added.

The region, already the world's largest FDI recipient in 2019, received more than half of global FDI. Growth was driven by China, Hong Kong, India and the United Arab Emirates.

Elsewhere in the region, FDI contracted. In economies where FDI is concentrated in tourism or manufacturing, contractions were particularly severe.

The report said FDI prospects for the region are more favourable than the global outlook with a projected growth of 5 to 10 per cent, thanks to resilient intraregional value chains and strong economic growth prospects.

Signs of trade and industrial production recovering in the second half of 2020 provide a strong foundation for FDI growth in 2021.

Manufacturing, an important FDI sector for the region, already showed signs of recovery in the second half of 2020.

However, in smaller economies oriented towards services and labour-intensive industries -- particularly hospitality, tourism and garments -- FDI could decline further in 2021.

(The above story is verified and authored by ANI staff, ANI is South Asia's leading multimedia news agency with over 100 bureaus in India, South Asia and across the globe. ANI brings the latest news on Politics and Current Affairs in India & around the World, Sports, Health, Fitness, Entertainment, & News. The views appearing in the above post do not reflect the opinions of LatestLY)

Quickly

Quickly