Mumbai (Maharashtra) [India], November 6 (ANI): RBI Governor Shaktikanta Das clarified on Wednesday that changing the monetary policy stance to 'neutral' does not mean a rate cut in the central bank's next policy announcement.

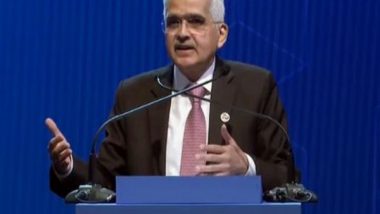

"It should not be assumed that we have done this, so therefore the next step is a rate cut. A change in stance doesn't mean that the next step is a rate cut, in the very next meeting. It's not so," Das said. RBI Governor was speaking at the BFSI Insight summit in a fireside chat with a business daily.

The Reserve Bank of India (RBI) has not changed interest rates for nearly two years but has adopted a neutral stance in its policy statement in October. This has sparked speculation of a likely rate cut in the next policy.

The next course of action has to be taken very carefully, Das said, hinting at significant upside risks to inflation expectations.

Significant risks, according to the RBI, include continuing geopolitical conflicts, geo-economic fragmentation, climate and weather-related risks, and commodity prices going up.

He had said in his monetary policy statement last month that September and October inflation prints were expected to be higher. September retail inflation came at 5.5 per cent.

"I reiterate it again today, October inflation, CPI numbers are again going to be very high, perhaps higher than the September number. So, therefore, we had warned it in my monetary policy statement," Das asserted.

The RBI monetary policy committee's shift to 'neutral' indicates that it is open to adjusting interest rates based on economic conditions.

Before that, the stance had been 'withdrawal of accommodation', meaning a more restrictive monetary policy stance where the central bank aims to reduce the money supply in the economy to contain inflation.

RBI kept the policy repo rate unchanged at 6.5 per cent for the 10th consecutive time. The central bank's commitment to bringing inflation down to its 4 per cent target on a sustained basis continues to face challenges due to ongoing food inflation.

The next RBI monetary policy meeting is due in the first week of December. (ANI)

(This is an unedited and auto-generated story from Syndicated News feed, LatestLY Staff may not have modified or edited the content body)

Quickly

Quickly