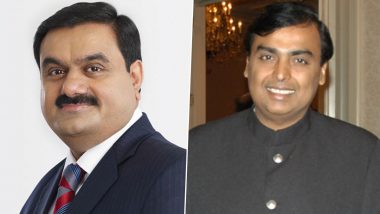

Ahmedabad, March 2: Leading US-based Global Equity GQG Partners announced on Thursday the completion of a Rs 15,446 crore (USD 1.87 billion) in a series of secondary block trade transactions in the Adani Portfolio companies -- Adani Ports and Special Economic Zone, Adani Green Energy, Adani Transmission and Adani Enterprises.

These firms were all listed on the Bombay Stock Exchange and National Stock Exchange. The investment has made GQG a key investor in the development and growth of critical Indian infrastructure. Jefferies India acted as the sole broker for the transaction. ‘Vinod Adani Pledged Adani Group Promoter Stakes for $240 Million Loans From Russian Bank’: Hindenburg Research Shares Forbes Report on Gautam Adani’s Brother.

A block trade in which the issuer sells shares is known as a primary offering and one in which the selling stockholders sell shares is known as a secondary offering. Adani Group Enters Industrial 5G Space, Acquires Right To Use 400MHz of Spectrum in 26GHz Millimetre Wave Band.

Rajiv Jain, Chairman and Chief Information Officer (CIO) of GQG Partners, said: "I am excited to have initiated positions in the Adani companies. Adani companies own and operate some of the largest and most important infrastructure assets throughout India and around the world."

"Gautam Adani is widely regarded as among the best entrepreneurs of his generation. We believe that the long-term growth prospects for these companies are substantial, and we are pleased to be investing in companies that will help advance India's economy and energy infrastructure, including their energy transition over the long run," Rajiv Jain said.

Jugeshinder (Robbie) Singh, Group Chief Financial Officer of Adani Group, said: "We are delighted to complete this landmark transaction with GQG. We value GQG's role as a strategic investor in our infrastructure and utility portfolio of sustainable energy, logistics and Energy Transition."

"This transaction marks the continued confidence of global investors in the governance, management practices and the growth of Adani Portfolio of companies," Jugeshinder said.

(This is an unedited and auto-generated story from Syndicated News feed, LatestLY Staff may not have modified or edited the content body)

Quickly

Quickly